More than 70,000 wildfire emergencies occur globally every year, leading to billions of dollars in damages to businesses, homes, and public lands. In California alone in 2020, wildfires burned across 1,443,152 acres, a 952% increase over the same time period in 2019. Just two wildfires in California during the 2020 season cost insurers between $9 billion and $13 billion alone.

What used to be a once-in-a-lifetime event now happens with startling regularity, so much so that wildfires now have their own “season.”

The 2021 season is shaping up to be just as devastating. California and much of the Western US are at risk again thanks to the drought. Despite some snow over the winter, this spring is the third driest on record. With wildfires becoming a regular risk, here’s what insurance companies need to know and consider when thinking about the impact of wildfires.

Wildfire Risk: What Insurers Need to Know

Fires are one of the most dangerous weather events that affect livelihoods, businesses, homes, and your local economy. For insurance companies, it’s vital to understand the risk of wildfires across different parts of the United States and the damage it causes to property and people.

With accurate weather data about wildfire risk and active fires, you can:

1. Communicate with At-Risk Customers with Active Fire Alerts

The first thing is a way to manage, predict, and understand fire risk.

Track fire alerts so that businesses and individuals can prepare and evacuate if necessary with Tomorrow’s alert system. With the API, you can get two pieces of data important in tracking fires:

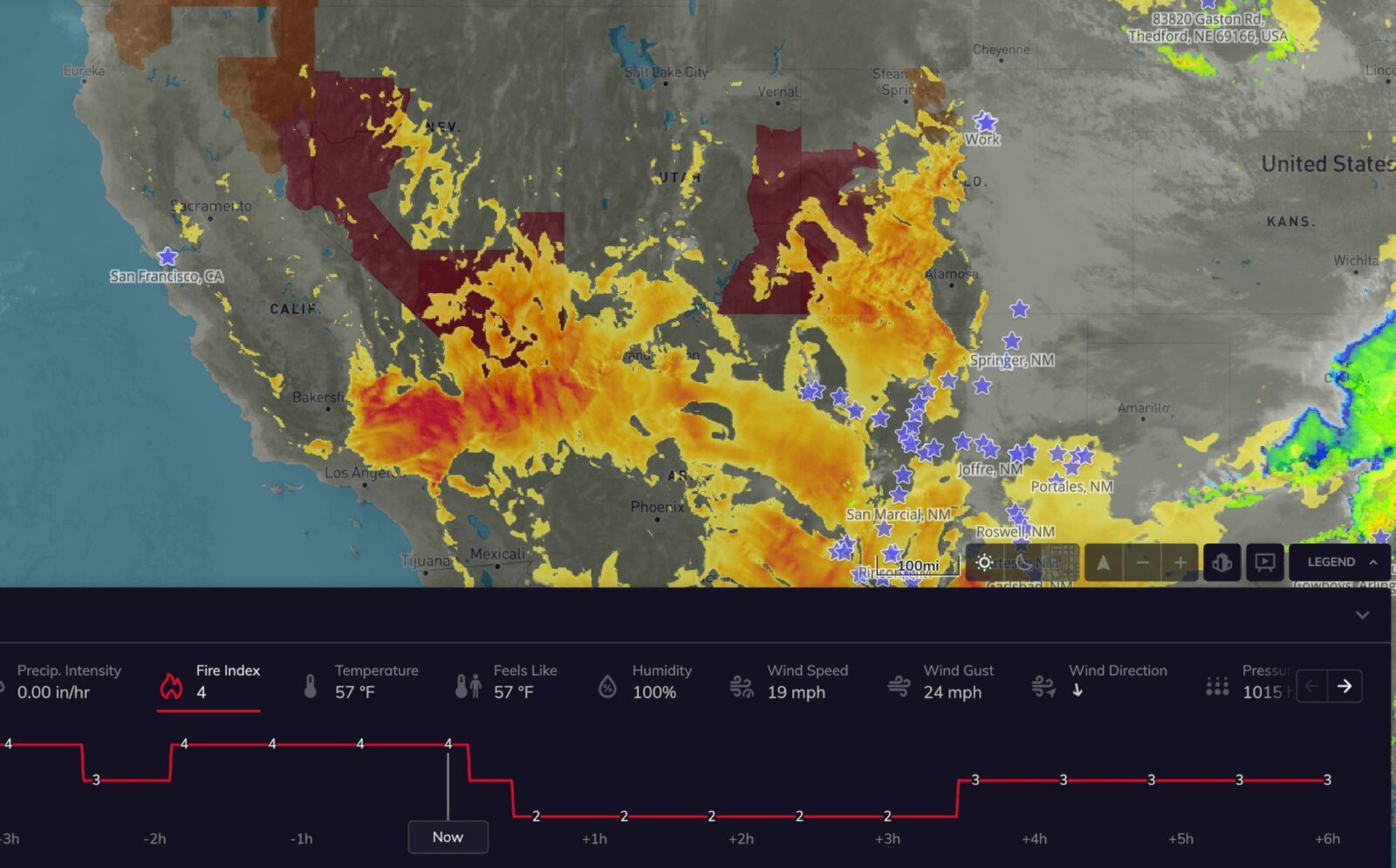

- Fire Index: The Fire Weather Index (FWI) is an integer value from 1-100 that indicates the intensity of fire potential within a region. With the Fire Index, you can understand the potential risk of fires in an area and alert customers.

- Active Fires Alerts: This value provides a percentage of probability a fire will occur or a fire has been observed. With Active Fires, you can understand where and when there is currently a fire, so you can understand exactly what’s happening throughout your coverage areas and process claims quickly and effectively.

With the Tomorrow.io platform, you can create automated alerts to send to your customers when there is a risk or an active fire in their area. This could be an advance warning for wildfire risks, evacuation notices for active fires, and proactive tips for customers around safety and planning.

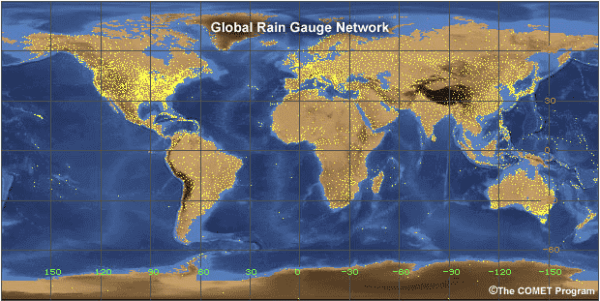

2. Ensure Complete Coverage Across All At-Risk Areas

For customers in wildfire-affected areas like California and the Western United States, it’s becoming harder and harder to find insurance coverage. The California Department of Insurance reported a 10% increase in insurers refusing to renew policies or offer additional coverage.

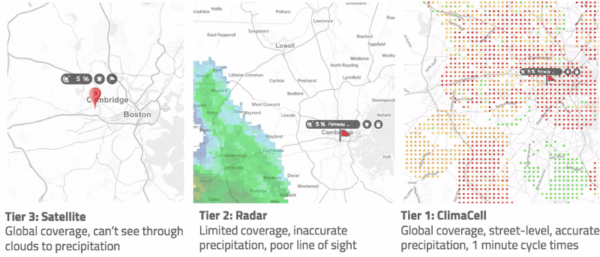

This hesitation comes down to a lack of understanding of wildfire risk in a given area. Wildfires aren’t unpredictable. Using a combination of historical data and active fire alerts, insurers can become proactive when it comes to assessing wildfire risk, instead of trying to control the damage afterward. Incorporating weather data into your risk tables with Tomorrow.io empowers insurers to fully understand the risk they’re taking on — and how that may change in the next year or few years.

As extreme and everyday weather continues to evolve, insurers need up-to-date data and a way to get actionable insight into local weather events and long-term changes in the climate if they are to provide affordable coverage, mitigate risk, and manage their losses.

In 2020, Hiscox, an underwriter at the insurance market Lloyd’s of London, paid to license a risk model for wildfires in the United States. Shree Khare, head of catastrophe research at the company, said that it will help Hiscox set premiums more accurately and that without the model it might otherwise have stopped insuring some clients in high-risk areas.

Incorporating weather data into your risk tables will give your organization more confidence about wildfire coverage — and give you a competitive advantage by offering wildfire insurance when other companies choose not to. The more you understand where hail occurs and the overall likelihood of secondary events, the easier it will be to offer new and additional packages based on those needs.

3. Assess Wildfire Impact Beyond the Immediate Area

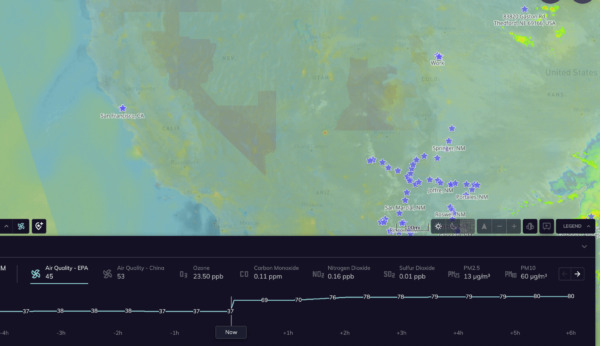

Wildfires do more than impact the immediate area of the fire as people evacuate homes and businesses. In fact, smoke from the wildfires in California is visible as far away as Kansas, causing air quality to reach dangerous levels that are unsafe to breathe.

As an insurer, you need to understand primary and secondary effects of any weather events, as well. Poor air quality forecasts create an entirely new set of problems, including elevated health risks for those suffering from COPD or asthma, as well as business problems from shutdowns or lower demand due to air quality.

That’s why Tomorrow.io also provides hyperlocal air quality information so you can understand not only high-level air quality indexes from EPA stations and street-level information. For example, Tomorrow.io offers 200 air quality data points across San Francisco, compared to one value on the EPA AirNow platform.

Real-time data analysis highlights how the pollutants are distributed across an area based on a number of parameters including:

- Air quality and atmospheric chemistry model forecasts

- Road network

- Satellite and ground-based air pollutant observations

While the wildfires will subside, the ongoing risk of future fires and day-to-day air quality management is here to stay. Insurers incorporating actionable air quality and wildfire alert data into their existing insurance product offerings and operational strategies have a distinct competitive advantage in assessing wildfire risk.