Tomorrow.Impact:

Tomorrow.io’s ESG Program

Develop and Implement an Effective Strategy from Disclosure to Climate Adaptation

As a global society, we all experience the impact of climate change daily and are fighting for a better future. For the next generation of industry leaders, the focus is on innovation across climate adaptation, sustainability, and resilient operations. With Tomorrow.io’s weather and climate security platform, your organization can enable climate adaptation at scale.

Tomorrow.io Helps JetBlue to Automate Weather and

Climate-Related Decisions Impacting 40 Million

Passengers Yearly at Scale

Our ESG Advisors

Cecile Blilious

Head of Impact & Sustainability at Pitango Venture Capital

Cecile Blilious is the Head of Impact & Sustainability at Pitango Venture Capital. Cecile specializes in merging technology, profit, and social impact, and is considered a pioneer of the impact industry in Israel as well as a thought leader of the impact industry worldwide, having founded Impact First Investments. Prior to founding Impact First, Cecile managed the Noaber Foundation’s Israeli investments for over 14 years and has extensive hands-on management experience with high-tech start-ups. Additionally, Cecile held executive positions and led several companies as a CEO and, on behalf of the Noaber Foundation, served as a chairperson and board member on many more. Cecile was one of the initiators of the Al-Bawader private equity fund, established to invest in businesses in the Arab community in Israel.

Keren-Or Rosner

ESG, Impact Consultant with Ray of Impact | Forbes 30 under 30 alumni | Google Impact Mentor and PRI Certified.

Keren-Or Rosner is connecting business leaders to profitable data. Expert in impact, ESG, diversity, equity, and inclusion, she promotes climate-resilient innovations for a systemic shift. She founded Ray of Impact, advising more than 100 investors, businesses, and mature startups. In addition, she lectures and moderates leadership workshops. Her former roles include Co-Founder of Sustainable Development Goals, SDG Israel, where she promoted ecosystems and investments among 3000 members, and CVC Lead at Japanese Global Robotic Corporation, helping startups in the industrial, health, and wellbeing sectors.

Greg Tully

Climate Analytics & Sustainability Advisor | Bain & Company External Advisor

Greg Tully is a data science team leader with significant top-tier management consulting experience. He holds a Ph.D. in cell biology and is currently receiving a Masters in Data Science at UC Berkeley to gain breadth and depth in data science while solving real-world problems—especially related to climate change & sustainability. Certified Sustainability and Climate Risk (GARP) professional.

Cecile Blilious

Head of Impact & Sustainability at Pitango Venture Capital

Cecile Blilious is the Head of Impact & Sustainability at Pitango Venture Capital. Cecile specializes in merging technology, profit, and social impact, and is considered a pioneer of the impact industry in Israel as well as a thought leader of the impact industry worldwide, having founded Impact First Investments. Prior to founding Impact First, Cecile managed the Noaber Foundation’s Israeli investments for over 14 years and has extensive hands-on management experience with high-tech start-ups. Additionally, Cecile held executive positions and led several companies as a CEO and, on behalf of the Noaber Foundation, served as a chairperson and board member on many more. Cecile was one of the initiators of the Al-Bawader private equity fund, established to invest in businesses in the Arab community in Israel.

Keren-Or Rosner

ESG, Impact Consultant with Ray of Impact | Forbes 30 under 30 alumni | Google Impact Mentor and PRI Certified.

Keren-Or Rosner is connecting business leaders to profitable data. Expert in impact, ESG, diversity, equity, and inclusion, she promotes climate-resilient innovations for a systemic shift. She founded Ray of Impact, advising more than 100 investors, businesses, and mature startups. In addition, she lectures and moderates leadership workshops. Her former roles include Co-Founder of Sustainable Development Goals, SDG Israel, where she promoted ecosystems and investments among 3000 members, and CVC Lead at Japanese Global Robotic Corporation, helping startups in the industrial, health, and wellbeing sectors.

Greg Tully

Climate Analytics & Sustainability Advisor | Bain & Company External Advisor

Greg Tully is a data science team leader with significant top-tier management consulting experience. He holds a Ph.D. in cell biology and is currently receiving a Masters in Data Science at UC Berkeley to gain breadth and depth in data science while solving real-world problems—especially related to climate change & sustainability. Certified Sustainability and Climate Risk (GARP) professional.

Helping Businesses Boost Their Climate Adaptation and Realize Their ESG Goals

Are you an advisor, strategic consultant, or an ESG platform?

Looking to advance your own ESG goals?

Our Impact

Overview of SDGs Addressed by Tomorrow.io

SDG 3 Promote Health and Wellbeing

3.9

By 2030, substantially reduce the number of deaths and illnesses from hazardous chemicals and air water and soil pollution and contamination

Potential Impact

Air Quality and Health Monitoring

Foster a healthy working environment for all employees by monitoring real-time air quality. Prioritize miners’ physical well-being while also ensuring the safety of the local community and surrounding environment.

According to the WHO, occupational exposure to outside air pollutants result in more than 860,000 deaths a year.

Industries Impacted

- Mining

- Warehouses

- Automotive

Used By:

SDG 7 Affordable and Clean Energy

7.3

By 2030, double the global rate of improvement in energy efficiency

Potential Impact

Weather and climate resilience play a key role in maximizing your operations efficiency and safety procedures. Optimizing the use of resources, preventing and restoring damages and better adjusting to weather-driven supply and demand.

Centralized Rules and Protocols

Determine the supply of electricity and demand for natural gas driven by upcoming weather.

Automated Decision-Making

Monitor all weather parameters needed to stay profitable and protect billion-dollar assets.

Predicted Energy Impact

Gain a marketplace advantage by understanding the weather impact in advance.

Industries Impacted

- Energy

- Electric Utility

- Municipalities

Used By:

SDG 8 Promote Sustained, Inclusive, and Sustainable Economic Growth

8.8

Protect labour rights and promote safe and secure working environments for all workers, Including migrant workers, in particular women migrants, and those in precarious employment.

Potential Impact

Save shifts and increase productivity, ensure crew safety by sending alerts and reduce hazards and material damage.

Establish preventative working measures and break schedules that will protect workers against weather related risks.

Industries Impacted

- Construction

- Automotive

- Field Services

- Warehouses

Used By:

SDG 9 Build Resilient Infrastructure, Promote Inclusive and Sustainable Industrialization

9.4

By 2030, upgrade infrastructure and retrofit industries to make them sustainable, with increased resource-use efficiency and greater adoption of clean and environmentally sound technologies and industrial processes, with all countries taking action in accordance with their respective capabilities.

Potential Impact

While the planet looks to cut emissions and find more sustainable ways to operate, the daily and weekly reality of weather continues to present significant risk to people, governments, and businesses around the world. Ships capsizing, energy grids failing, airlines delayed leaving passengers stranded…etc, the list goes on for most all industries. Longer-term planning is essential for businesses and ESG Climate risks mitigation offers that opportunity.

Environmental sustainability is an integral part of every business, within every industry. Gain a competitive advantage and drive outperformance by ensuring your company’s behavior is compliant with ESG principles. Tomorrow.io’s dashboards allow organizations to identify climate risks and implement strategies that improve employee wellbeing, reduce environmental risk, and maintain high levels of ethics and integrity.

Industries Impacted

- All Industries

Used By:

SDG 11 Sustainable Cities and Communities

11.5

By 2030, significantly reduce the number ofdeaths and the number of people affected and substantially decrease the direct economic losses relative to global gross domestic product caused by disasters, including water-related disasters, with a focus on protecting the poor and people in vulnerable situations.

11.6

By 2030, reduce the adverse per capita environmental impact of cities, including by paying special attention to air quality and municipal and waste management.

Potential Impact

While the planet looks to cut emissions and find more sustainable ways to operate, the daily and weekly reality of weather continues to present significant risk to people, governments, and businesses around the world. Ships capsizing, energy grids failing, airlines delayed leaving passengers stranded…etc, the list goes on for most all industries. Longer-term planning is essential for businesses and ESG Climate risks mitigation offers that opportunity.

Environmental sustainability is an integral part of every business, within every industry. Gain a competitive advantage and drive outperformance by ensuring your company’s behavior is compliant with ESG principles. Tomorrow.io’s dashboards allow organizations to identify climate risks and implement strategies that improve employee wellbeing, reduce environmental risk, and maintain high levels of ethics and integrity.

Industries Impacted

- All Industries

Used By:

SDG 13 Climate Action

13.3

Improve education, awareness-raising and human and institutional capacity on climate change mitigation, adaptation, impact reduction and early warning.

Potential Impact

Tomorrow.io’s dashboards allow organizations to identify climate risks and implement strategies that improve employee wellbeing, reduce environmental risk, and maintain high levels of ethics and integrity.

Longer-term planning is essential for businesses and ESG offers that opportunity, but as Elkabetz says simply disclosing climate risk is not enough for businesses. Solutions are needed to help operators manage and mitigate climate risk and weather security NOW.

The core problem Tomorrow.io’s dashboards solve is allowing operators to be proactive to weather vs. being reactive.

Industries Impacted

- Supply Chain & Logistics

- Mining

- Railroads

- Warehouses

- Transportation

- Municipalities

Used By:

Climate Security Platform

Automated Monitoring

Monitor any location globally 24/7 to mitigate the impact of climate risk

Day-to-Day Management

See your climate exposure holistically across both physical and transitional risk

ESG Optimization

Improve your operating results across both environmental and social initiatives

Avoid Disasters

Get ahead of short/long-term weather and climate impact before it's too late

Protect Your Bottom Line

Implement operating protocols to reduce risk and cost from weather-related events

Centralized Communications

Visualize weather and climate across your organization using a single source of truth

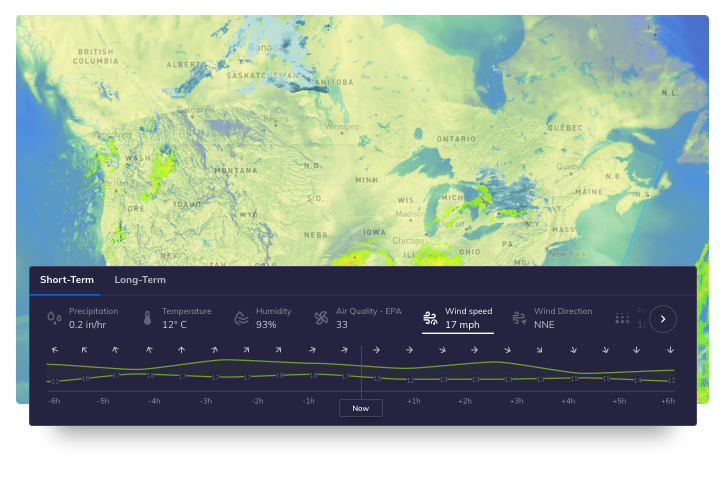

Weather Visualization Map

Displaying over 30+ different weather and air quality parameters, Tomorrow.io’s interactive map view enables users to visualize and track weather via color-coded layers, in addition to their short-term and longer-term timelines.

Learn more ›

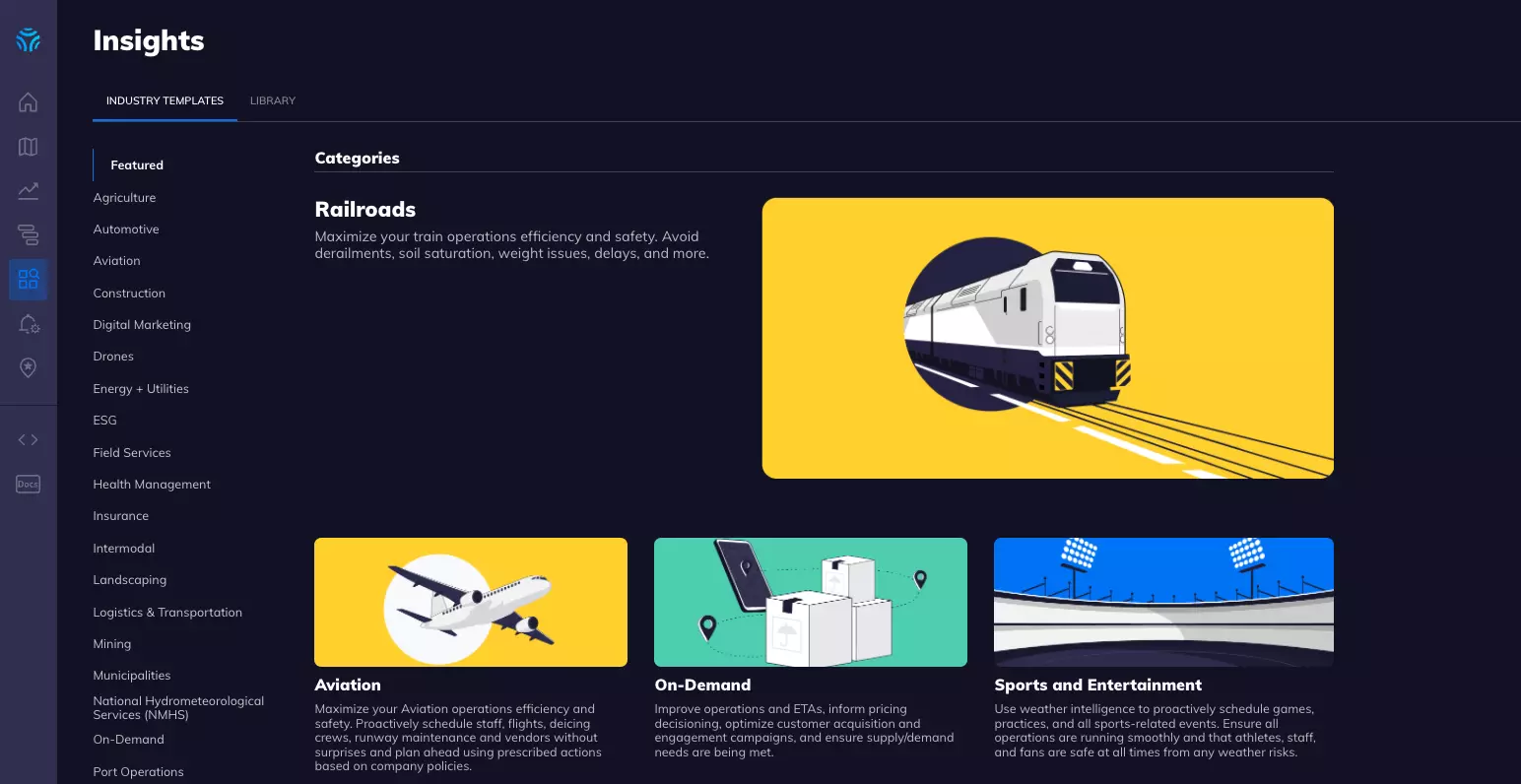

Predictive Insights Dashboard

Powered by Tomorrow.io’s proprietary data and machine learning, our robust Insights Dashboard provides a forecast of your business’ operations and action plans based on current and incoming weather.

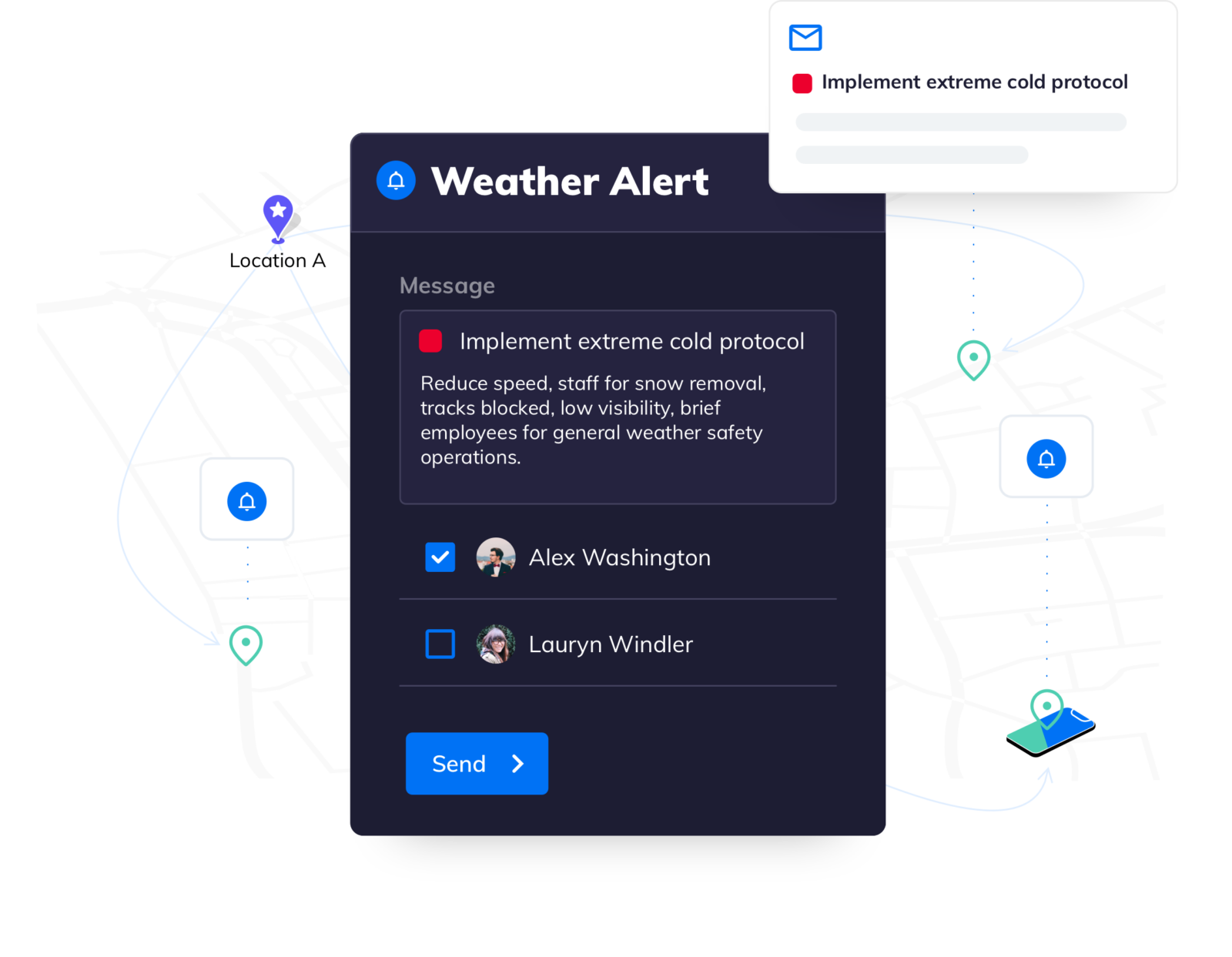

Learn more ›Dynamic, Actionable Alerting

Streamline communication with smart and dynamic alerting, ensuring the right individuals receive the right notifications at the right times. Provide necessary context and detailed action plans to save time and optimize efficiency.

Every Industry Problem—solved

Not every industry is impacted by weather in the same way. We have one platform that solves it all. Simply select your vertical and use case, and we’ll take care of the heavy lifting.

Start with templates ›Our Partners

The Climate Service

Our goal is to help investors, companies and communities to understand their risks from the changing climate, and the opportunities from the transition to a low-carbon economy.

Tomorrow.io ESG

Tomorrow.io is the world’s first weather and climate security platform, helping teams prepare for the business impact of weather by automating decision-making and enabling long-term climate adaptation at scale.

Our commitment to ESG standards is reflected not only in our mission and work, but also our corporate operations.

▼

▼

▼

Environmental

GHG Emissions

Tomrrow.io is committed to reducing our GHG emissions and developing towards a negative net zero goal.

Tomorrow.io is a Leaders for Climate Action Member, as part of our commitment to fighting climate risk. Carbon offsetting programs: planting trees for every Tomorrow.io employee.

Tomorrow.io participates in carbon-offsetting programs like the One Tree Planted organization. Our team planted 5,000 trees in January 2021 and continues to plant one new tree for every hire.

Social

Diversity and Inclusion

In 2021, 40% of Tomorrow.io’s US hires and 36% of our Tel Aviv hires were from underrepresented and diversified groups.

Stakeholder Engagement

Employee Engagement

The people of Tomorrow take ownership with a bias for action. We are transparent, honest, purposeful and passionate about making a difference.

We support team members with generous engagement opportunities that allow each person to bring their whole selves to work.

Competitive compensation and benefits

“Donut” and coffee meetings

Meeting freeze times

Outdoor gatherings and team building

Focus on execution, not numbers of hours

Flexible working hours

Growth opportunities

Flexible vacation policy 🙌

Tomorrow.io maintains a constant feedback loop with employees to understand engagement and sentiment through tools like Tinypulse. We survey each employee through a formal annual assessment and assess overall company feedback quarter.

Governance

Security and Safety

Tomorrow.io securely manages our data in order to protect the interests of our organization and the privacy of its clients.

We are aligned with the SOC2 certificate.

Tomorrow.io is proud to partner with TomorrowNow.org to address the urgent need for inclusive climate action.

Bridging the Gap Between Climate Security and Communities Most in Need Now

With Tomorrow.io as its technology partner, TomorrowNow.Org brings the latest climate action data and tools to at-risk communities today

Investing in Transformation of Weather Systems

We also work together with TomorrowNow to achieve long-term viability of weather and climate systems – the backbone of national climate resiliency – in underserved regions.

Everything ESG: The Guide to Environmental, Social and Corporate Governance

Everything ESG: The Guide to Environmental, Social and Corporate Governance

ESG is Environmental, Social, and Governance and these criteria are increasingly becoming central in corporate strategic development and planning, due in part to the tight connection between ESG and corporate financial performance. Not to belabor the point, but the criteria can be developed using the following heuristics:

- Environmental criterion – Accounts for how much a company balances energy intake and output; how much of an impact a business has on the physical surroundings; offsetting energy-intensive operations with renewable energy investments

- Social criterion – How people perceive a company as it carries out operations in the midst of broader society and within a diverse ecosystem of commercial stakeholders; Diversity, Equity, Inclusion; public reputation and company perception are paramount; and

- Governance criterion – A set of internal policies that serve as the compass for a company to move ahead and grow; how the company conducts itself apart, as well as with strategic partners; what steps the company takes to meet the varying consumer demand while staying within the lanes set forth by federal, state, or local law

With these definitions in mind, it is then perhaps more straightforward to imagine how a well-thought-out ESG strategy can enhance the position of a given corporation. A company with exemplary ESG records will be favored for gaining access to new markets via federal purchasing and licensing agreements (which is very appropriate in light of recent legislation proposed in U.S. Congress – see below). The corporation focusing on revamping environmental strategy will unlock greater operational efficiency too, given advances in renewable technologies, etc. Third, sound governance up front can alleviate external regulatory pressure over time.

And to drive the point home, financial researchers have shown that a strong ESG proposition generates tangible value both for corporations and their shareholders in the long run. ESG is trending strongly upward and total addressable market opportunities in the space hover at $10-20B (or more) annually. According to public reports, actively managed investment assets have eclipsed $1T on a quarterly basis at major investment firms. As we will illustrate, these market dynamics are attributable to an emerging global sense of imminent climate-related risk to property and wellbeing.

So this is about reinvesting, or doubling down if you will, on ESG policies to promote sustainable business futures and ultimately a healthier planet for posterity’s sake. And one aspect we’ll pause to highlight is sustainability, because make no mistake, comprehensive and recent scientific reports continue to show that the future is looking bleak from a climate-centric view. Thus, the road to true business sustainability is going to be long and winding. We offer this piece as a roadmap of sorts for the corporate strategist and engaged global citizen alike.

The Current Climate-Risk Disclosure Landscape

Global civilization has been treading precariously close to defaulting on the Paris Climate Accords of 2015: the rate of total greenhouse gas emissions continues to speed up, global average temperatures are rising, and there are manifestations of these trends in the form of significant weather impacts which are difficult to ignore (more on this below). Despite the Paris Climate Treaty’s ratification by more than 190 countries, timely and decisive actions to stem the impacts of climate change have been glaringly absent worldwide. That is, up until the last several years. Whether it is the result of heightened awareness of scientific developments, real-life experience, or the result of proceedings in Paris is uncertain, but there has been an awakening to the realization that climate change is a formidable challenge to global prosperity.

The Financial Stability Bureau (FSB) was originally chartered by the heads of the G20 back in 2009, and thereafter in 2015, the FSB sanctioned the formation of an industry-led Task Force on Climate-related Financial Disclosures (TCFD). Rather quickly, in the span of about two years since its origination, the TCFD drew up a series of guidelines for how companies can and should disclose the impact of their operations on natural systems, the risk inherent to people’s investment choices, and how executive decision making bodes for the future. Since being developed, the TCFD’s “rules” for disclosure have thus served as the international benchmark.

Spurred by the collection of scientific reporting and multi-national summit proceedings in the climate change science arena, the United States’ legislative and executive branches too have shifted into higher gear, especially in 2021.

And yet what will be done to address the needs of the American public? Enter U.S. President Joseph R. Biden Jr. For his part, President Biden re-elevated the climate responsibility discussion when he issued Executive Order (E.O.) No. 14008 (“Tackling the Climate Crisis at Home and Abroad”; signed January 27th, 2021). The President then further promulgated his administration’s intent to take action in reaction to the “Climate Crisis” with E.O. 14030 (“Climate-related Financial Risk“; May 20th, 2021). Among other things, the latter order does the following:

- Establishes policy to, “…advance consistent, clear, intelligible, comparable, and accurate disclosure of climate-related financial risk…”; and

- Tasks federal officials to carry out comprehensive domestic financial risk assessment to ensure the stability of the Federal Government and U.S. financial systems (all within 120 days following the ink drying on the President’s signature)

Responding to executive orders and recognizing risks posed by climate change, the United States Department of Defense announced in April that it would accelerate plans to conduct systematic climate vulnerability assessments on its installations at home and in key strategic defense outposts worldwide – to be completed within 24 months. They are using geographic information systems infused with cutting-edge climate projections to determine asset vulnerability, which in theory will help bolster military readiness and lethality.

On the legislative front, the House of Representatives narrowly passed H.R. 1187 in June. According to Title IV, Sec. 402 therein, the Congress has understood that,

“…requiring companies to disclose climate-related risk exposure and risk management strategies will encourage a smoother transition to a clean and renewable energy, low-emissions economy and guide capital allocation to mitigate, and adapt to, the effects of climate change and limit damages associated with climate-related events and disasters…”

To put it simply, Congress too is “urgently concerned” about climate change, some of the Peoples’ representatives are willing to go all-in on a clean-energy revolution, and will support that transition in a number of ways. More specifically, the so-called “Climate Risk Disclosure Act of 2021” includes that:

“…short-, medium-, and long-term financial and economic risks and opportunities relating to climate change, and the national and global reduction of greenhouse gas emissions, constitute information that issuers…should regularly identify, evaluate, and disclose…”

Congress would thus be tasking the U.S. Security and Exchange Commission (SEC) to draft a set of rules governing disclosure (principally relating to climate-risk). Independent of recent Congressional debate, the SEC concluded a three month public comment period in June and SEC Chair Gary Gensler gave public remarks which included that he requested SEC staff to “develop a mandatory climate risk disclosure rule proposal for the Commission’s consideration by the end of the year.” However, the other SEC Commissioners are not unanimous in support and some Members of Congress oppose the rulemaking, so at this point, new mandates for disclosures are still not set in stone.

The U.S. is evidently taking a proactive approach here by setting hard deadlines too; the House bill requests that the SEC be accountable and have the rules drawn up in place within two years (which means by mid-2023). If not, issuers would then need to comply with the TCFD recommendations laid out and amended in 2017. According to the recent TCFD annual status report from 2020, 1,500 companies from around the world support the TCFD’s rules on climate-risk disclosure (an 85% increase since June 2019), including financial organizations that manage over $150T in assets. At the very least, it is a significant signal that the Federal Government is taking up the debate on ESG impacts.

How Does ESG Incorporate Climate Risk?

Recall from above, President Biden reiterated dire climate risks that the global community is facing. The previous E.O. 14030 also prioritizes procurement opportunities and federal grants for demonstrably “green” initiatives going forward. Both President Biden and U.S. Congress have previously alluded to the “Social Cost of Carbon”, i.e., heat-trapping greenhouse gases that are liberated principally by commercial endeavors and how we must account for foreseeable damages to public health, agriculture, infrastructure, and ecosystems, etc. Now here we have a literal call for corporations to augment ESG programs (emphasis on “Social” here…) across the board and as soon as possible. So yes, the link between ESG and corporate financial performance is apparent, but now the onus is on corporations to do whatever they can to do right by shareholders and the public. This means that now companies must do something to address climate risk, e.g., elucidate the impacts of their business’s practice on the environment and society, and they must be very transparent in doing it.

There are several aspects worth elaborating on with respect to the issue of required financial disclosures. The first being that rules surrounding disclosure for climate-related risk have previously been somewhat nebulous. Before the TCFD stepped in to provide a degree of procedural clarity, corporations were essentially writing their own scripts. Outside of having voting rights, shareholders and public stakeholders were removed from influencing the path of ESG policy creation too, if there even was any to begin with. Secondly, adequate accounting of climate exposure for corporate entities in different sectors was and still is a challenging prospect on the surface. Prior scientific uncertainty about changing climate and the extent to which people – let alone companies -are responsible for the phenomenon has hampered even the most diligent of environmental and social accounting efforts. Then there is the link between climate and weather to comprehend, which compounds the problem further. Historically speaking, companies have often fallen short in their respective bouts contending with climate risk.

The difficulty of anticipating climate impacts with great acuity motivates a short sidebar. In the atmospheric sciences, technical research evolves in the various sub-disciplines of the field almost independently; for example, the study of different flavors of the El-Niño Southern Oscillation has been siloed from investigations of precipitation microphysics. It was not until recently that we discerned that the “phase” of tropical circulation can excite severe weather complexes capable of deluging sub-tropical geographies far away. New discoveries by colleagues in academia have therefore inspired entire generations of players in private and commercial markets, Tomorrow.io included; we now see unabating climate change as an opportunity…

Weather is the Expression of Climate

There is the familiar notion that climate is glacial, perpetual. Climate change incessantly inches forward, almost imperceptible to the casual observer. Tremendous amounts of heat and moisture are transported by planetary-scale ocean currents and atmospheric circulations over weeks, to months, and on up to decades. A high-pressure block in the jetstream, forced in part by atmosphere-ocean interactions that cycle every 10-30 years or so (e.g., prevailing climate patterns), sets the background stage for what transpires on smaller scales for hours or days.

Whereas weather is volatile, more ephemeral, and its innate turbulence can jolt one to the core. The weather can spin-up, often in dramatic fashion, at a particular place and time. Cue: a low-pressure system tearing down the front range of the Rockies in February, arctic cold surging into the deep southern U.S., followed by an onslaught of mixed precipitation. In truth, this very scenario played out and crippled an entire region of the U.S. for more than a week (arguably longer). Statistically speaking, this is a highly unlikely occurrence in the current climate state.

But climate is changing more rapidly than ever before in human history and is now widely acknowledged and mostly accepted by the world’s preeminent Earth scientists (more than 230 of them – that’s a big number of leading thinkers). And many public constituents too. While the rate of global greenhouse gas emissions continues to increase, temperature follows suit, seemingly in lock-step.

The latest Intergovernmental Panel on Climate Change Assessment Report 6 provides some eye-opening support to this as the global temperature follows linearly – almost exactly – to the build-up of greenhouse gas emissions in the atmosphere. Even if we were somehow able to eliminate fossil fuel use tomorrow, the anthropogenic greenhouse gas contributions to date almost guarantee that climate warming would continue for another twenty years or longer. Making the case for instituting far-reaching climate mitigation strategies is easier when we consider the following key messages from the sixth assessment report:

- In each of the last four decades, the average global temperature was warmer than any decade prior in human-recorded history, dating back to 1850

- The seven hottest years that the world has ever seen (in terms of global average surface temperature) have occurred since 2014

- Comparing 1900 to the twelve years leading up to 2018, the rate of global mean sea level rise has accelerated by almost a factor of three

- Global warming caused by humans is now “unequivocal” and has contributed significantly to the observed temperature changes since the pre-industrial era

IPCC Warming:

- Changes in average global surface temperature from over the last 2020 years rebuilt from paleoclimate records and observations since 1850 (left)

- Change in average global surface temperature modeled with the human influence (orange), with only natural sources of variability, and from human observations (black) (right)

Climate science experts meanwhile have found that the changes to mean global climate (think increasing ocean heat content, increasing sea level, rising surface air temperature, and elevated atmospheric water vapor content) have contributed in varying degrees to weather-related disasters in recent times.

And therefore, the weather, intense weather, will inevitably continue to reflect that series of changes in the climate system. This is more than just a hypothesis because we have seen these phenomena play out on numerous occasions, over many disparate regions. It almost seems like with the turn of every new month, there is some location on Earth that is experiencing unprecedented environmental tumult.

- From reliable records dating back to the beginning of the 20th century, the year 2020 set the record for the most named tropical systems in the Atlantic Ocean basin

- Hurricane Dorian set the record for the strongest tropical cyclone in the Atlantic in 2019, whipping winds up over 180 m.p.h. During the storm’s peak intensity over Elbow Cay in the Bahamas

- An extreme deluge over Hanalei Bay on the north shore of Kauai in April of 2018 led to 49.69 inches of rain – in just 24 hours

- In 2013, researchers in El Reno, OK measured winds of 296 m.p.h. inside the widest tornado ever observed (2.6 miles) as it reached max intensity

- The hottest temperature ever reliably recorded worldwide was 130.0°F (54.4°C) on July 9, 2021 at Furnace Creek, CA, which broke the prior record of 129.9°F (54.4°C) set at the same exact location just one year prior

- In the 80-100 years before 2021, locations in near-coastal Washington and Oregon rarely reached 100°F, but in late June of 2021 Portland International and Seattle-Tacoma International airports broke all-time daily maximum temperature records with over 103°F – on three days in a row.

The list goes on and recent events point to changes in the climate system exerting significant pressure on daily weather extremes. For example, this summer’s heat in the Pacific Northwest was 30-40°F above normal. It was even hotter in western Canada, where the national temperature record was set one day at Lytton, British Columbia (49.6C, 121°F), before wildfire was ignited and burned through the town the next. The scientific consensus though (which is sustained by climate projections looking even more than a century ahead) is that such “routine” weather occurrences will continue to become more severe, more spatiotemporally extensive, and occur more often. So what are we to do?

Decarbonization is Only Part of the Solution

A primary focal point of discussions on ESG strategy and what we do about climate change is decarbonization – efforts to virtually wean ourselves off of burning fossil fuels to drive growth across the global economy. Going a step further, there has been much innovative hype surrounding the prospect of removing carbon from the atmosphere as a way of enhancing climate change mitigation efforts. But with the current state of the global supply chain and many iterations that will be required before carbon sequestration technology can work at scale, mitigation strategies will hedge on using less. Period. Indeed, much of the public and private sector vision is toward a paradigm shift to renewable energy, such as wind and solar solutions (we cannot forget that the U.S. government has also signalled that it is all for this transition). And weather intelligence will continue to be a fundamental part of that transition.

To facilitate wind-, solar-, and hydro- power assessments and the renewable energy transition, the short-term variability of parameters like low-level winds, cloudiness, and precipitation must be accurately captured and precisely quantified. Otherwise, calculating renewable power potential on-site and estimating the long-term profitability of new and existing projects would be nearly impossible. Specifically, what are the atmospheric conditions over a given mountain plateau, open field, or reach of a particular watershed? Climate models are adept at providing large-area context (like regions spanning hundreds of miles) for up to hundreds of years or longer, but they leave much to be desired in the way of details around key operational assets. The critical capability that we are alluding to is localization for multiple weather phenomena at once.

Tomorrow.io has developed a veritable arsenal of weather intelligence solutions and more: the extensive historical archive, the current conditions layer, NowCast, and the Comprehensive Bespoke Atmospheric Model system (CBAM). Both NowCast and CBAM deliver unmatched resolution and refresh rates for tracking weather over entire continents. Every single weather analysis happens in near-real-time and operational forecasts systems are initiated as quickly as every five minutes. Tomorrow.io’s proprietary software and models are able to resolve weather volatility – the rapid, impactful weather fluctuations that many other models crucially miss. With such granularity, Tomorrow.io provides confidence metrics and the most likely range of conditions for individual points in the field. Moreover, we continuously store current conditions analyses in our historical archive – which now houses many terabytes of data in the cloud – for easy recall on-demand.

All this is combined into the Tomorrow.io Platform, which provides for the synthesis of multiple weather features of interest at once. Whether it be an exceptional drought in one end of the domain and severe winds with flash flood potential in the other, the Platform intelligently recognizes the intersection of weather perils and provides actionable insights automatically. And the Tomorrow.io Platform’s event-based thresholding is customizable to suit a diverse range of enterprise-level use cases. Interests in the energy, transportation, on-demand, construction, food service, and retail sectors have used the Tomorrow.io Platform for generating greater margins, commonly through gains in process optimization and operational efficiency. And this is all in the face of weather that has manifested throughout various epochs of changing climate.

On Implementing ESG Strategy

The trouble with incorporating holistic ESG strategy in a successful business venture (say, judged by ESG standards plus the customary financial markers) is that it can necessitate an overhaul in terms of the approach to market. Still, developing an effective ESG strategy and having a plan to implement it are different than actually enacting programs that eventually scale on their own. There is also a history of far-reaching, visionary programs getting stuck – because of the lack of funding, waning stakeholder commitment, and so forth. Any number of logistical hurdles can arise and collectively they portend the inability of a given corporation to execute on ESG strategy and reap the verifiable benefits.

From the foregoing discussion, motivation to do social good and new-found corporate incentives around incorporating ESG criteria into operations are crystal clear. But the emphasis must be on ascertaining barriers to implementation accordingly. Stakeholders that are critical for mission success should be invited to the table from the get-go so that they may contribute diverse perspectives as part of an equitable and inclusive exchange of ideas. It is imperative for corporate leadership in businesses subject to climate-related exposure to maintain an open, agile, adaptive mindset as market dynamics change, occasionally as fast as the weather itself.

Weather Intelligence is the Answer to Climate Risk

Improvements in the accuracy and precision of climate predictions have engendered greater confidence in the model outcomes which are predicted for varying time horizons ahead of the present time – for the year 2030, 2050, or 2100. We have sharper depictions of what the future state of the climate will be in terms of sea level, glacial extent, temperature, and hydrology. Downstream from there, specialists typically set assumptions and subsequently model climate risk for assets spanning multiple sectors or regions. This methodology has been tried and proven for creating decision support tools before. Yet there are still sources of uncertainty, such as what emissions trajectory we ultimately follow. If there is more consumption in general, nearly all indications are that the hotter our world will become. The other glaring piece of uncertainty is what that actually entails for individual stakeholders.

Remember that weather is the expression of climate, and any company that cares about the climate will inevitably care about the weather. Maybe a touch unrealistic, but customers often expect that climate information will be specified according to their unique use cases. This sets a high bar. The SEC delivering on its initiative to further promote comprehensive climate-related financial disclosures will be only part of the solution. The remaining pieces of the climate-risk product value chain involve translating climate prognostics into localized weather impacts, which are then used to greatly refine risk and vulnerability assessments. Here is where Tomorrow.io is changing the game.

Our core specialty is weather intelligence and we’re investing millions of dollars into the Tomorrow.io platform to mitigate and adapt to climate risk. We do this by bundling proprietary machine learning and physical numerical weather modeling together at the highest possible resolution. The models we build are trained to be intensely sensitive to the inputs that they are initialized with – if the climate forcing changes in the background then our models readily adapt to that stimulus. Tomorrow.io is well-positioned to provide that final mile of impact prevention as actionable insight for multiple weather hazards.

The industry-wide movement toward adopting loftier ESG criteria targets is undeniable and the groundswell of public approval only adds to that momentum. By virtue of its cutting-edge weather intelligence technologies, Tomorrow.io is helping companies achieve these strategic objectives with greater ease, thereby uncovering long-term value propositions on the order of billions of dollars each year. However, the best part is that by focusing on sustainable governance practice, prosperity does not come at the expense of pristine environments and social values. That’s a cause worth investing in.