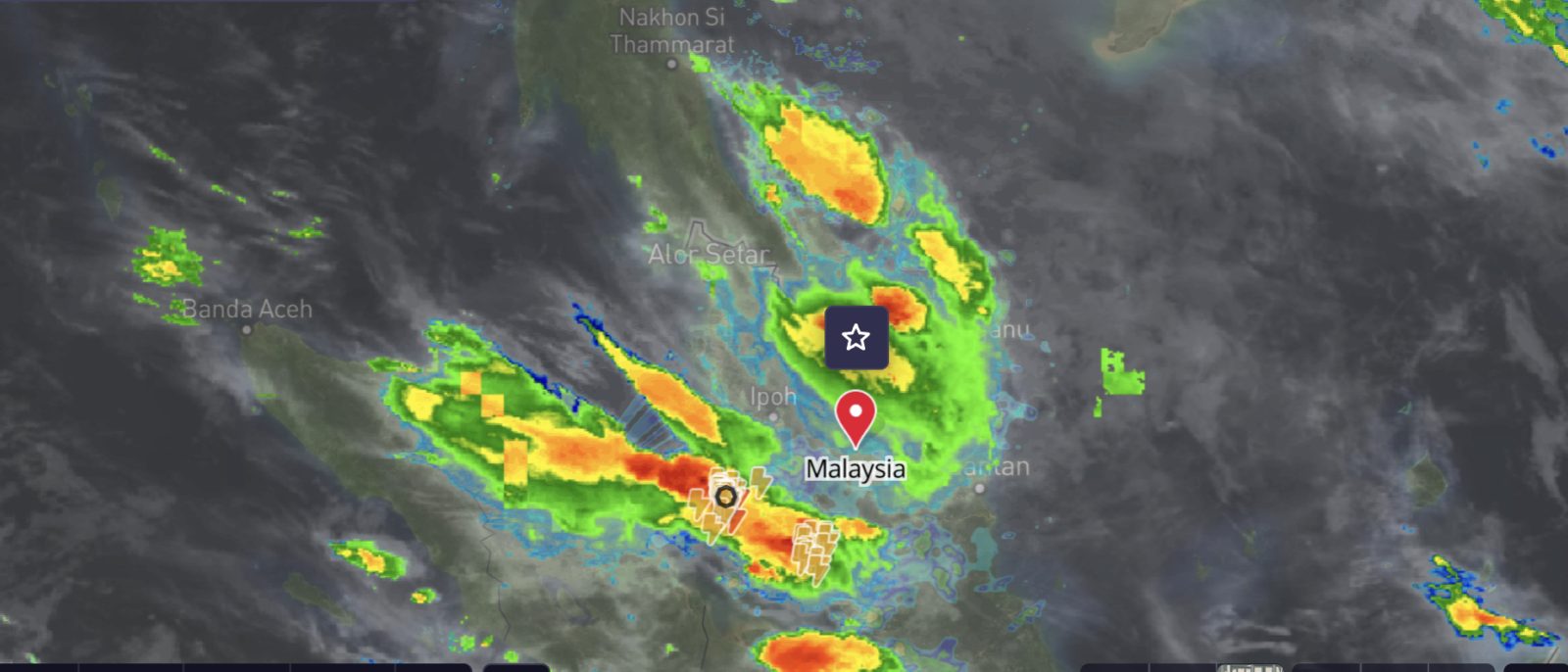

Extreme flooding hit nearly every corner of the globe in 2021. Devastating rains left almost 200 people dead in Germany and the Netherlands while torrential monsoon rains in India and record-breaking rainfall in China caused devastating impacts to the community. London also suffered recent flash flooding, and Storm Elsa left New York commuters wading through waist-deep water on subway platforms. Most recently, days of torrential rain in Malaysia caused the worst flooding the country has seen in decades.

Floods are the most common natural disaster in the US. The consensus from scientists seems to be that climate change is making the weather systems more severe, and they predict that extreme weather will occur more frequently in the future. Reflecting on the floods in Germany, for example, climate change experts said that they fear human-caused disruption is making extreme weather even worse than predicted.

According to Sanjay Srivastava, Chief of Disaster Risk Reduction at UN-ESCAP, climate change has had a part to play in each of these extreme weather events despite the different locations and contexts.

While climate change experts have been shocked at the extent of recent extreme weather events, businesses can’t afford to be blindsided by future flooding and must take steps to prepare.

Insurance Industry: Counting the Losses

For the insurance and reinsurance industry, flooding is an expensive issue. Europe’s recent flooding is expected to become one of the costliest events on record with expected losses in the billions of Euros. In fact, insurance company Aon warned that the weather could drive insured losses of more than $4.5 billion.

While 2021 brought what seemed like an unprecedented level of rainfall and flooding, this trend is hardly a one-off. In 2019, economic damage globally from flooding was $82 billion, which was the greatest total of any natural disaster.

Insurers also need to be aware of flooding-related secondary perils, which are small-to-midsize weather events or the secondary effects of a primary peril. Secondary perils include hail and flash floods, as well as secondary effects, such as:

- Property losses for structural damage

- The expense of living costs while the home is being repaired or rebuilt

- Commercial losses, such as loss of income

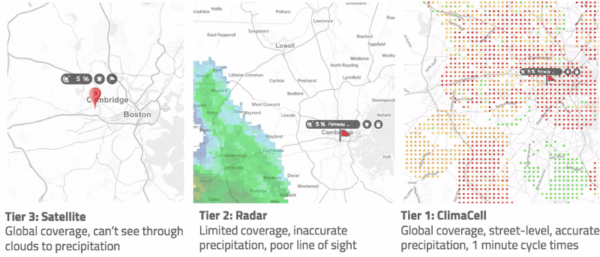

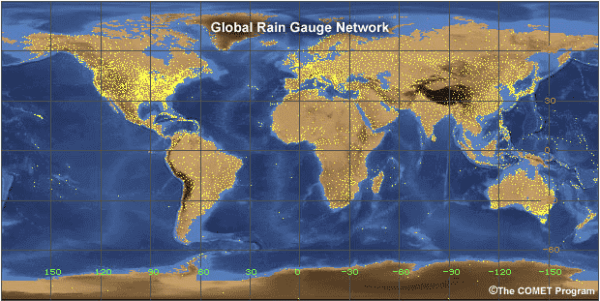

As secondary perils are often localized and short-term, historical data isn’t enough to be able to manage risk. Insurers need to understand and assess secondary perils on a case-by-case basis and to do that, they need localized, real-time data.

Relying on historical data and not having insight into current trends can also push premiums higher, which risks pricing both consumers and businesses out of the market. Currently, many businesses haven’t got adequate insurance to protect their assets from damage caused by flooding.

A recent survey revealed that nearly three-quarters of businesses are aware of their flood risk, but less than half say they have comprehensive flood cover. These organizations without comprehensive insurance were also the most worried about business continuity.

Insurers need up-to-date data and a way to get actionable insight into local weather events and long-term changes in the climate if they are to provide affordable coverage, mitigate risk, and manage their losses.

Impact on Flooding on Business Continuity

The insurance industry isn’t alone in being affected by flooding. From damage to equipment, buildings, and stock, reduced access to premises, and transportation problems, businesses across all industries face major business continuity risks.

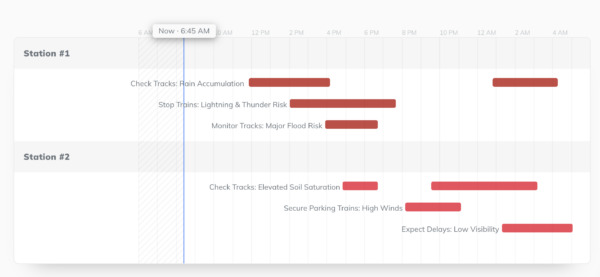

In the railroad industry, flood water can cause a short circuit on a live circuit rail, which stops trains from running. If flood water rises above the rails, trains have to reduce their speed to prevent damage. Wiring and power supplies in points and signaling equipment can fail during flooding. Maintenance teams need to replace or repair these assets before trains can run again.

When rail links are broken, this impacts the intermodal industry as a whole, as cargo doesn’t get in and out as needed. This disrupts the entire supply chain. During the flooding in Europe, German steel making giant Thyssenkrupp could not get raw materials. This, in turn, had a chain effect on industries such as automotive, limiting them from getting parts in time.

Utilities and energy companies face a similar risk of damage to their equipment from flooding. In 2017 during Hurricane Harvey, wind and catastrophic flooding knocked down or damaged more than 6,200 distribution poles and 850 transmission structures.

While greater use of renewable energy is seen as an important way to reduce greenhouse gas emissions and slow climate change, these power plants are often in the line of fire when it comes to flooding. Many hydropower stations in Germany were out of operation during the flooding and teams had to carry our clean-up operations and pump out water before bringing the plants back online.

Mitigating Flood Risk: Be Prepared

Preventing floods from happening isn’t always possible. While investment in flood defense infrastructure can reduce the devastation ––like the Netherlands’ investment in widening and deepening river channels –– businesses still have to be prepared.

According to flood experts, “Large-scale early warning systems, emergency evacuation strategies and plans to ensure that people know what to do when the time comes were all essential tools to policymakers seeking to improve flood preparedness.”

This advice also applies to businesses looking to mitigate flood risk. Early warning systems and making sure that people know what to do in the event of a flood are crucial.

Henk Ovink, a flood expert and the Netherlands’ special envoy for international water affairs, also has this advice, “Take climate change into account in everything you do”.

One of the most well-known effects of climate change is rising sea levels, which will further endanger coastal areas. Having the insight to project where and when that rise could translate into increased flooding is important for planning where to build new premises and monitoring future risk.

The bottom line? Businesses need to consider both climate change and weather. They must understand what is going to happen in the immediate future in specific locations, while also uncovering insight into longer-term weather predictions.

Weather intelligence software provides predictive and customized weather insights that enable you to get the right information to drive actions that can mitigate risk and help you prepare for all eventualities.

Do You Understand Your Weather Risk?

Get a Free Assessment Today.