TL;DR:

- Unpredictable weather patterns have caused significant damage to properties in recent years.

- Advanced weather prediction technologies can improve risk assessment, policy pricing, and claims management in property insurance.

- Weather data helps insurance companies accurately assess risks, set premiums, and enhance operational efficiency.

- Tomorrow.io offers tools and solutions to integrate precise weather data into property insurance policies.

- Utilizing weather prediction technologies is crucial for insurance companies to protect property owners, ensure profitability, and stay competitive.

The past few years have been rough for property owners.

The culprit?

Weather.

Over the last few years, property owners have faced increasingly unpredictable weather patterns, which have caused significant damage to buildings and personal property.

According to a recent property insurance study, severe weather caused $121.4 billion in property damages in the U.S. between 2017 and 2021. It’s estimated that 25% of those damages were not covered by insurance, creating an alarming need for effective risk management strategies in property insurance.

Insurance companies face the challenge of accurately assessing these weather-related risks to provide adequate coverage while maintaining profitability.

This is where advanced weather prediction technologies come into play. By leveraging detailed and accurate weather data, insurance companies can significantly improve their property insurance policies, resulting in better risk assessment, precise policy pricing, and efficient claims management.

Let’s explore how insurance businesses can use weather data to enhance their property insurance offerings, ultimately saving money, time, and effort.

Understanding Property Insurance

Definition:

Property insurance is a type of coverage designed to protect buildings and personal property against the financial risks associated with adverse weather conditions. This insurance can cover losses due to events such as storms, hail, floods, wildfires, and other weather-related disasters. By providing a safety net, property insurance helps ensure that property owners can recover and rebuild even after experiencing significant weather-related damages.

Common Challenges:

Insurance companies face several challenges when offering property insurance. One of the most significant is accurately predicting weather-related risks. Traditional methods of risk assessment often fall short due to the inherent unpredictability of weather patterns. Additionally, determining the appropriate pricing for policies and managing claims efficiently adds to the complexity. These challenges highlight the need for more sophisticated tools and data to enhance the effectiveness of property insurance.

The Role of Weather Data in Property Insurance

Advanced Weather Prediction Technologies:

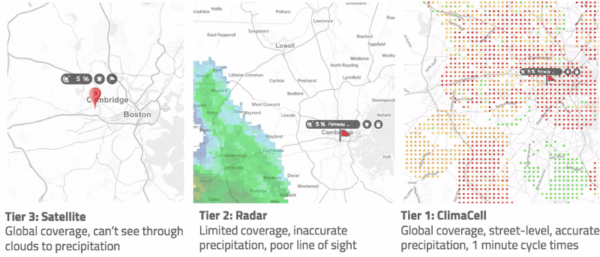

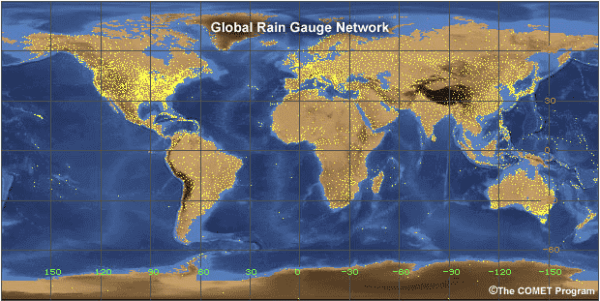

Weather prediction technologies have advanced significantly in recent years, providing more accurate and granular data than ever before. These technologies utilize satellite imagery, radar systems, and sophisticated algorithms to forecast weather conditions with high precision. This wealth of data allows insurance companies to make informed decisions about risk assessment and policy pricing.

Types of Weather Data:

Several types of weather data are particularly relevant to property insurance, including:

- Temperature: Monitoring temperature variations can help predict heatwaves and cold snaps.

- Precipitation: Accurate data on rainfall helps assess the risk of floods.

- Wind Speed and Direction: Understanding wind patterns is crucial for predicting storms and hurricanes.

- Fire Risk Indices: Data on dryness and wind conditions help predict wildfires.

By leveraging these data points, insurance companies can better understand the weather-related risks that affect properties and tailor their policies accordingly.

How Weather Data is Utilized in Property Insurance

| Aspect | Description | Example |

|---|---|---|

| Risk Assessment | Weather data is crucial for assessing the risk of adverse weather events. By analyzing historical weather patterns and forecasting future conditions, insurance companies can determine the likelihood of events such as storms, floods, and wildfires. This data-driven approach allows for a more accurate evaluation of risks associated with insuring properties. | For instance, an insurance company might use historical flood data to assess the flood risk for a particular region. By comparing this data with current weather forecasts, they can make informed decisions about the level of coverage required. |

| Policy Pricing | Accurate weather forecasts and historical data help insurance companies determine the appropriate pricing for their policies. By understanding the risk factors associated with different weather conditions, insurers can set premiums that reflect the true cost of coverage. | A hypothetical scenario might involve an insurer using wind speed and direction data to price policies for properties in a region prone to hurricanes. The data enables the insurer to offer competitive premiums while ensuring they remain financially viable. |

| Claims Management | Weather data can streamline the claims management process by providing real-time insights into weather events as they occur. This helps insurers quickly validate claims and determine the extent of damage. | An example could be the use of real-time storm tracking to verify property damage claims following a severe storm. This allows insurers to process claims more efficiently and accurately. |

Impact Areas for Insurance Companies

Accurate weather data brings substantial financial savings to insurance companies.

By leveraging precise risk assessments, companies can set premiums that accurately reflect the likelihood of weather-related events.

This ensures that collected premiums are adequate to cover claims, preventing financial strain. For example, an insurance company using advanced weather prediction technologies to evaluate flood risks can avoid unexpected high payouts during flood seasons, thereby optimizing financial resources and enhancing profitability.

Operational efficiency is another significant benefit. Integrating weather data into the underwriting process streamlines operations, reducing the time and effort required for risk assessment and policy adjustments. Automated data analysis and risk evaluation enable quicker decision-making and policy issuance. An insurer utilizing automated weather data analysis can swiftly adjust policies and premiums in response to changing weather forecasts, ensuring that their coverage remains relevant and accurate without extensive manual intervention.

Provide accurate and timely coverage based on weather predictions to greatly enhance customer satisfaction. Property owners benefit from insurance policies tailored to their specific weather-related risks, ensuring they receive appropriate compensation when adverse weather events occur. For instance, a property owner with an insurance policy that includes real-time storm alerts can take preventive measures to protect their property, reducing losses and increasing trust in their insurer. This proactive approach leads to higher customer loyalty and positive word-of-mouth referrals.

Tomorrow.io’s Tools, Solutions, and Services

Tomorrow.io offers a comprehensive suite of tools and solutions designed to enhance the effectiveness of property insurance policies through precise weather data. Their advanced weather prediction technology leverages satellite imagery, radar systems, and sophisticated algorithms to provide accurate and granular weather forecasts. This enables insurance companies to make informed decisions regarding risk assessment, policy pricing, and claims management.

One of the standout features of Tomorrow.io’s weather data is its versatility.

Insurance companies can take weather data, such as historical archives and real-time weather insights, and integrate it into their claims to validation system. For instance, insurers could cross-reference a property owner’s claim of damage due to a storm with real-time storm alerts and historical weather data, ensuring accurate and justified payouts.

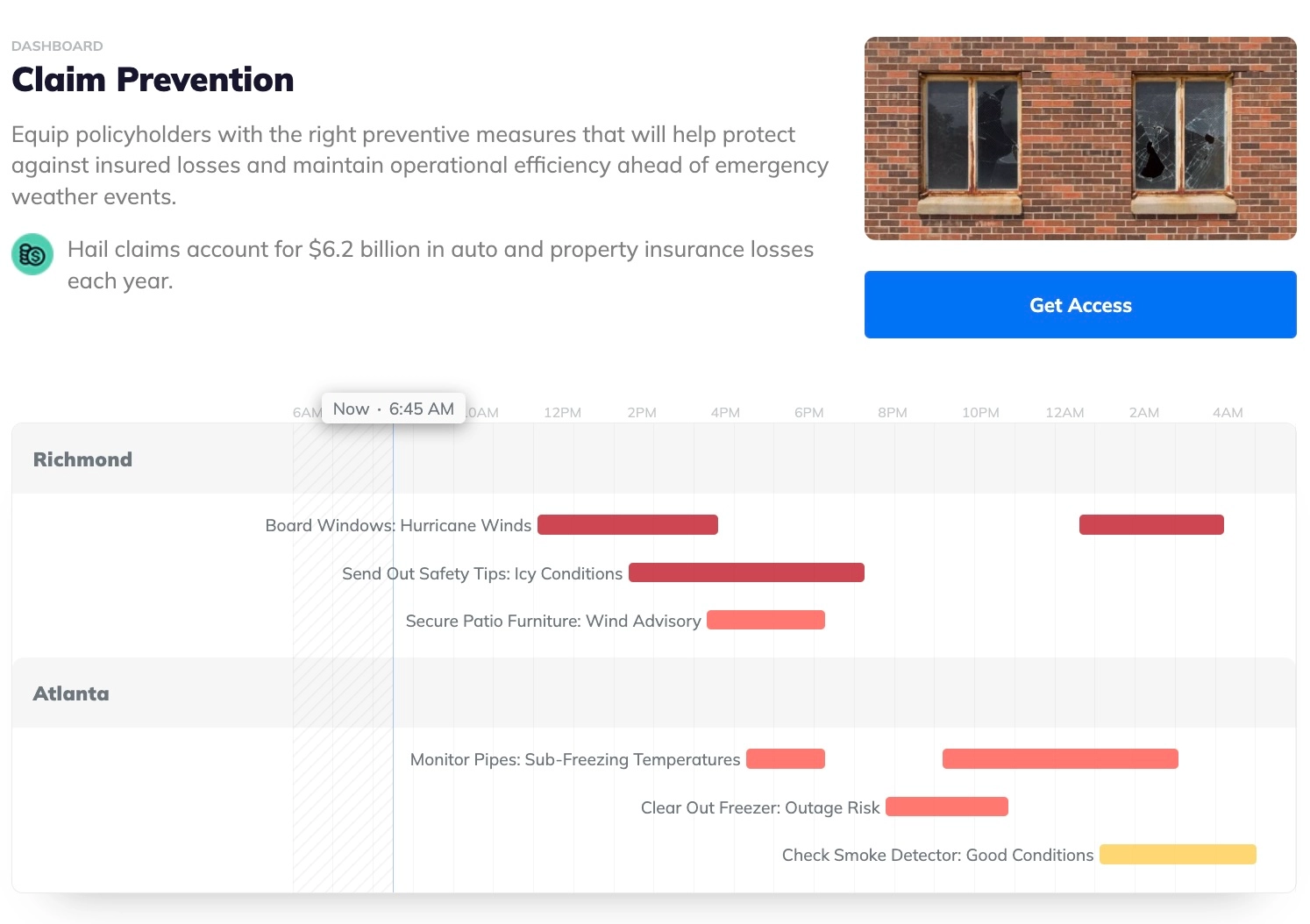

Tomorrow.io also facilitates informed decision-making by offering precise early warnings and preventative measures for extreme weather events. Insurance companies can provide policyholders with timely alerts about impending weather conditions, allowing them to take preventive actions. This not only reduces potential damages but also enhances customer satisfaction by demonstrating proactive support.

Moreover, Tomorrow.io’s predictive coverage needs feature helps insurers engage with policyholders to offer tailored policy recommendations. By analyzing weather data, insurers can identify regions at higher risk for specific weather events and offer appropriate coverage options.

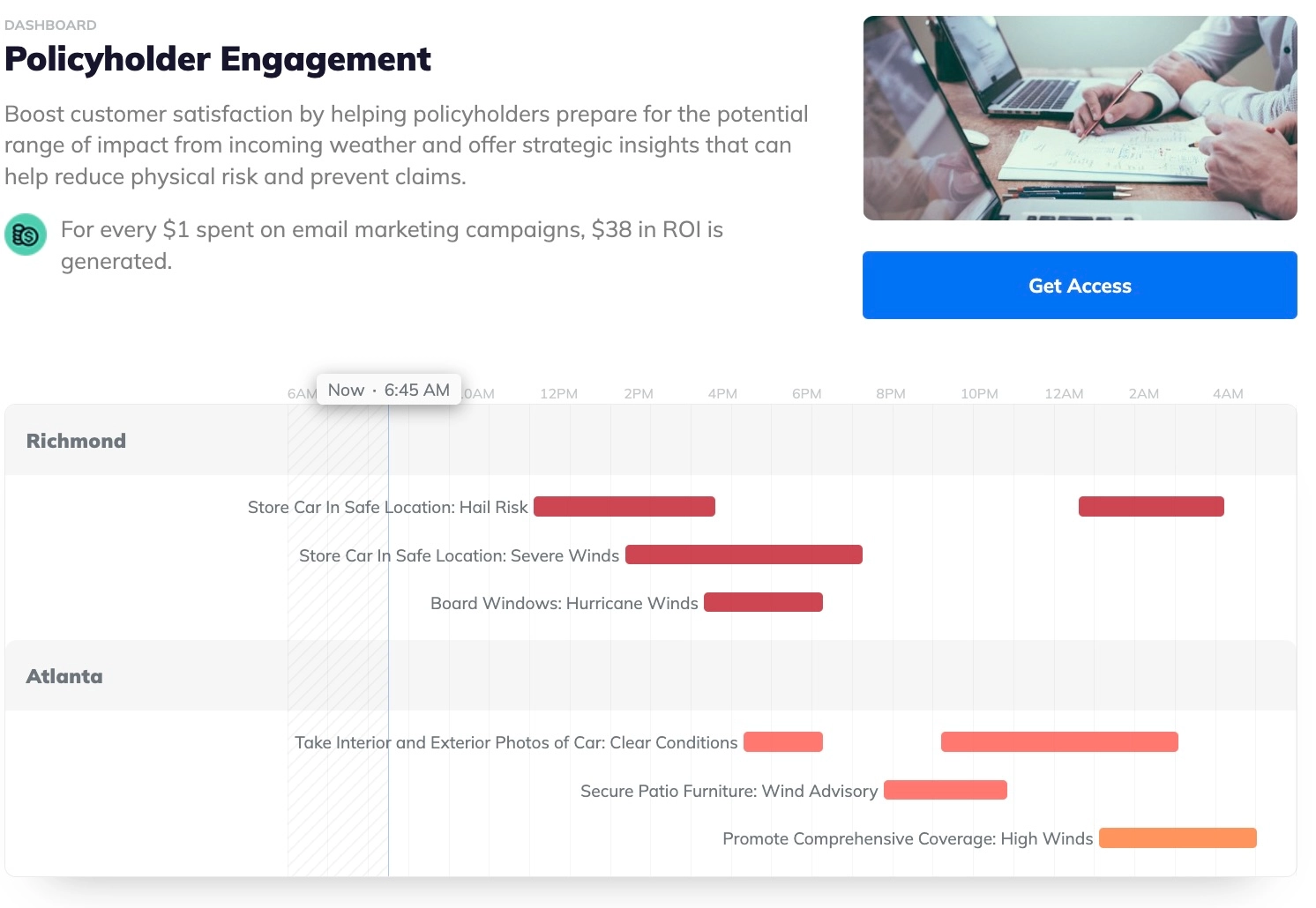

Additionally, Tomorrow.io’s pre-built insurance dashboards provide a quick start for companies looking to integrate weather data into their operations. These templates help insurers rapidly deploy solutions for flood risk management, storm damage claim prevention, and policyholder engagement, boosting operational efficiency and customer satisfaction.

By integrating Tomorrow.io’s cutting-edge tools and solutions, insurance companies can enhance their property insurance offerings, streamline operations, and improve customer satisfaction, ultimately leading to better financial outcomes.

Conclusion

Integrating advanced weather data into property insurance policies offers significant benefits for insurance companies.

By leveraging Tomorrow.io’s cutting-edge tools and solutions, insurers can achieve accurate risk assessment, precise policy pricing, and efficient claims management. This approach not only leads to substantial financial savings and operational efficiency but also enhances customer satisfaction through proactive support and tailored coverage options.

Utilizing weather prediction technologies is essential in an industry where weather unpredictability poses significant challenges. Insurance companies that embrace these advancements will be better equipped to protect property owners, ensure profitability, and stay ahead in a competitive market.