This week, our CEO Shimon Elkabetz sat down with the Absolute Return podcast to discuss what inspired him to start Tomorrow.io, how our weather and climate security platform translates hyperlocal forecasts into actionable insights, and the growing importance of ESG.

Listen to the episode on Spotify, Apple podcasts, Audible, and Podbean and check out the full transcript here:

Welcome investors to The Absolute Return Podcast. Your source for stock market analysis, global macro musings and hedge fund investment strategies, your hosts, Julian Klymochko, and Michael Kesslering aim to bring you the knowledge and analysis you need to become a more intelligent and wealthier investor. This episode is brought to you by Accelerate Financial Technologies. Accelerate because performance matters. Find out more at accelerateshares.com.

Julian Klymochko: So, I’m excited to chat about Tomorrow.io with the co-founder and CEO. Shimon welcome to the show. Really excited to have you on today. And one thing that I noticed going through your background is you spent 10 years in the Israeli military prior to founding the company. And something hit me in that I’m thinking like, is it a coincidence? Because it seems like this keeps happening where coming across public company, CEOs and entrepreneurs that spent, you know, a number of years in the Israeli military. And I was wondering, is it a coincidence or is there something specific within that experience, that program that sort of creates entrepreneurs and business leaders? What do you think about that?

Shimon Elkabetz: Yeah, obviously, you know, books, we’re reading about it and it’s a quite discussed phenomena and I think there is a connection. I think, you know, a population that majority is serving in the military because it’s a mandate. When kids in college in the U.S. are thinking about their identity. Kids in Israel think about their unit. It’s a different experience, which is unfortunately making you more mature sooner, and you faced different leadership challenges earlier. If I had to name one thing, it makes you feel like you can achieve things. If you set a goal and you go after a it with discipline and maybe that’s one area. Specifically, for me, I can say that the experience in the air force actually taught me and turned me into a super user of everything related to weather and climate. In the cockpit as a manager of operations. I saw firsthand, how limited the technology is, and unfortunately, I saw people who lost their lives due to weather related accidents. And it drove such a passion for me about trying to solve this problem. And that was the driver for me to go after this.

Julian Klymochko: That’s interesting because the next topic I wanted to touch on is getting into Tomorrow.io. what it does? Describe as the world’s weather and climate security platform. Was there a light bulb moment that you thought of this idea? How did it come to fruition such that you are confident that this could ultimately become a sizable enterprise?

Shimon Elkabetz: Yeah, so, you know, there’s always this classic story about the idea and how it came about. I wouldn’t say that Tomorrow.io has an idea. It is set around a specific problem and a very big problem. And the problem is climate change. The fact is that weather events, because of climate change simply become more frequent and more volatile. This is a phenomenon that is only going to accelerate and it’s a big problem. And what we are set to do is to help countries and businesses manage their climate security challenges. That’s what we want to do as a company, equip humanity with this intelligence that is needed to adapt to a change in climate. Is it a one idea? Absolutely not. We started with a specific technical idea, but I think what made us very unique as founders. Rei the co-founder, Itai the third co-founder. They went to MIT; I went to Harvard business school. We started the company over there. We all had shared experiences around the challenges of weather around how limited the technology we saw was, but we were mature enough and actually business savvy enough to understand that, to build a real company, a really big company, you have to focus on a problem and not on a solution because solutions come and go, but it you’re focused on a problem that is big enough. You can be solution agnostic and keep reinventing the business around how to solve that problem. And when we talk more about what we do, you’ll see that we do so many things, but eventually the common theme is how do we help countries and businesses manage their weather and climate related challenges.

Michael Kesslering: And so, after identifying that problem, can we get into a little bit, like you said, how you’re coming to a solution with this? How you’re using machine learning to translate these hyperlocal forecasts into actionable insights?

Shimon Elkabetz: For sure, yeah. First of all, the business model of Tomorrow is a vertically integrated one, meaning that we have a value chain that starts from how to create the weather data in real time in the forecast, all the way to a software for every job in every vertical that provides business for recommendations. This is a business model that doesn’t exist elsewhere. It’s a very comprehensive one and it’s actually three companies in one. What do I mean by that? The first division of the company is focused on sensing. Sensing from all kinds of unique devices, including launching our own satellites. We’ll talk more about that. That’s what you need to understand weather in real time. You need sensors, right? The second division is a weather one. Modeler’s scientists that actually runs own models on our own computer to process and understand what will, be the weather in every part of the world on a hyper local fashion.

And the third vision is around product and engineering, how to take that information and serve it to any job in any vertical, in a way that they understand it, and it provide business recommendations. AI, machine learning, these are passwords. We’re not defining ourselves as a machine learning company. Do we use machine learning? Absolutely. In all kinds of pieces. In the models, in the insights. But again, going back to my first comment. We’re not focused on a technology. If I need to build, you know blocks from the street in order to help my customers I’ll do that. We’re focused on the problem. Machine learning is one of the tools in our disposal. Specifically, the models we run are physical models, numerical weather predictions, but we also, you use machine learning to optimize these models and to use a bunch of different models, which learn from what happens and using assemble. We create better forecasts that takes into account all kind of models. What actually happen, what is relevant to every specific domain. But this is really only part of what we’re doing. I want to highlight that.

Julian Klymochko: So, you mentioned three divisions. Sensing, you’re launching satellites, then the weather modeling aspect, and thirdly, offering up that data through product and engineering teams. Was wondering from a consumer or client perspective, how is Tomorrow.io, better than existing technologies? And this question is coming from someone with literally no idea of what happens behind the scenes. I know my iPhone tells me the weather and I’ve seen weather radar on the weather channel. And that’s about all I know with respect to telling whether or not it’s going to rain or snow or be hot or cold.

Shimon Elkabetz: Yeah. Actually, we have a consumer app. It’s part of the product engineering division. And just like our business solution. It doesn’t just give you raw data. It tells you, when is the best time to go for a run, walk your dog, you know, Netflix and chill, do whatever activity you choose to do. How are we differentiated as the company? The first thing is that, until today. Weather forecast and technology were dominated by governmental agencies. To generate a weather forecast. You need sensors like radars and stations. You need models into which you assimilate the sensing data, and you need computing power. You process the model of the output is a weather forecast. All of that end to end was done traditionally by Noah [Inaudible 00:08:54] in the US, ECMWF in Europe, the Met Office in the UK and everybody else were just repackaging it, no matter what app you’re using, you’re basically using the same governmental outputs of models that are repackaged by all kind of companies.

Now you go outside of the U.S. and Europe and then you don’t have data because there are no agencies with investment to create real time data. Now, in that context, Tomorrow.io is running its own models into which it assimilates public data, proprietary data, and soon our radars from space that we’re going to launch starting at the end of 2022. This is differentiated because for the first time in history, a private company is running models at scale that only governmental agencies did until today. Now this is big. In that context, we are trying to become the SpaceX of weather.

Because we are augmenting what the governments do similar to the way SpaceX is augmenting NASA work. And by the way, we’re already working with Noah on running Noah models in the cloud. It’s a project called Epic. We’re partnering with the U.S. air force to use our satellites to run model. We’re going to partner with more and more agencies. NASA is consuming some of our products already. So that’s one element. The other element of differentiation is that think about the complexity of weather and the different verticals. Just think about it individually. Let’s say, Michael you like to run, and you Julian like to surf. You care about whether differently, right? Now, let’s take you to the business. Delta Airlines, Uber and the NFL, very different use cases, right? Different solution required, different value proposition, different buyer in the organization. And most of the industry players that played until today. Not only did they repackage the governmental forecast, they couldn’t productize across all of these verticals.

So, what they became is service providers who sell meteorology support over the phone. We created a product that is easily configurable for every job in every vertical, in every part of the world. Think about Microsoft Excel. You have templates and it doesn’t matter if you’re a CFO, VP of sales or a dispatcher in an airline, you will know how to use Excel for your own needs. That’s the product we built. You have templates if you’re trying to optimize transportation company with weather disruptions, you’ll have a template for that. You’ll be able to configure it to your own needs with your own threshold. And it’ll tell you when to reroute, when to hold the dispatch and such. But if you are a farmer, it’ll tell you when to irrigate and when to plant. So, we’re configuring it.

We’re enabling automation, and we’re going the extra mile to tell you what to do about the weather and not just what is the weather, which is a whole different level of value proposition for the customer. So, you can see that it’s such a comprehensive business model, not only more accurate weather data, which is a company of its own to do that with a lot of PhDs, a lot of patents and technology, we actually serving it in a modern, sleek SAAS that anyone can understand. Every company that works with us, suddenly says, now everybody’s meteorologist in our company, and we don’t need to go and translate it through a third party or something like that.

Julian Klymochko: Right, and you did mention or several of your customers, Delta, Uber, NFL. I was wondering, could you list the specific use cases in which or the reason why they’ve signed up for your platform? What benefit does it provide to them?

Shimon Elkabetz: Yeah, so let’s look at for example, utilities, right? An example is in degree, the utility company in India. So first of all, in India, the weather forecast is not very accurate because you do don’t have radar distribution in the country, and we don’t have high resolution models. So, they chose to work with us because of the improved accuracy using our model output on the Indian continent. But when they started working with us in April 2020, they didn’t envision that a month later in May, they would see the largest cycle in the last 20 years [Inaudible 00:13:41]. And when that happened, our dashboard, didn’t just tell them, you know, where the trajectory of the storm will be. It actually gave them a very specific recommendation, three position crews next to three towers out of 300 towers behaving in a specific region because that’s where the damage will be.

They listen to that, and they say that thanks to Tomorrow.io recommendation, they were able to avoid an outage to a hundred million people. Now you have 10,000 utilities in the world. We’re going to have more hurricane, more cyclones, and we can help any utility within an afternoon. We just need to deploy our software to the customer and upload the assets, simple as that. So why do they choose us? The accuracy, but also the fact that we gave them the right recommendation at the right time. And that’s a common theme. I’ll give another example. I cannot name it, but a company that has a lot of road transportation, logistics. Meaning, they need to move a lot of, let’s say cars from one place to another, and they need to deliver on time. They came to a pilot with us of about 30 days thinking that they’re going to be able to see how this product works, but within a day our product started telling them, hey, this delivery? Postponing it. Tell the customer, that you’re not going to make it on time, push it in 48 hours.

All this dispatch do X, Y, Z. Within a week or two, they came back and said, listen, we already made so many decisions that saved us so much money. Let’s get it going and signed it to your agreement with us. So, they don’t care about accuracy in that case, they just saw so many decisions that made such an amazing ROI for them. So, the combination of accuracy on a global scale, as well as business recommendations, that help you make right decision at the right time. That’s the power and the value position of our product.

Michael Kesslering: And nothing makes your growth easier than being able to show customers how can it impact their bottom line? But can we shift a little bit to your bottom line, and can you talk a little bit about your own unit economics at Tomorrow?

Shimon Elkabetz: Yeah, for sure. So first of all, the business is a SaaS business model. We sell annual subscriptions to the software. And the cost of running the software is coming from mostly clouds costs because we need to run the models. There’s a computing power to do that. The nice thing is that when we run a global model, we need to run it once and we can serve a million customers or one customer with that model. It doesn’t really matter. We already paid the price for running the model on a global scale or original scale. It doesn’t really matter. So, there is this fixed cost of running models, which grows with more region we run, but we pretty much exceeded the capacity. So that’s one area. As we grow the business, we are going to insert a hardware cost to a software company. We can talk more about why would a SaaS company grow as fast, decide to go to space and investing to hardware? But that will be additional cost. But the nice thing is, even with that investment, we’re still going to be in the 70 to high 80s in gross margins in the future, which is really, you know, best in class for SaaS companies. So, we’re truly a SaaS company in our profile. And we have a pretty clear path for profitability. And you know, it’s not something that a lot of SaaS companies can say, but we truly think and project that in the next three to four years, we can get to profitability.

Julian Klymochko: So, talk to us about this hardware aspect of the business. You guys are going to be launching satellites. That’s pretty exciting. How’s that going to work?

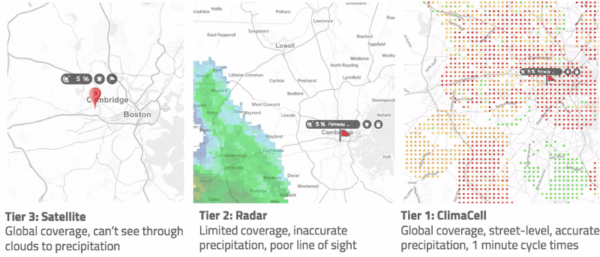

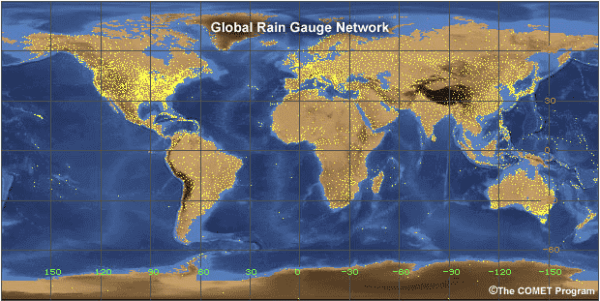

Shimon Elkabetz: Yeah, so why would the SaaS company go to space? Again, because we’re focused on the problem, the problem is climate security, and our goal is to help manage the challenges. And we found out that we’re still limited in how we’re helping our customers. Why? Because for example, in Mexico, or in Brazil, the data that we have to feed our models is not accurate enough. So, forecasts are less accurate. And the insights we give to customers are limited. Alright, why is it happening? Because we lack observations. The most important observation to drive weather forecast is radar. Without radar we do not know where it’s raining in real time and the forecast is inaccurate. If I showed you a map of the world coverage of radar, you would be amazed because over 5 billion people live outside of radar coverage. It means that 5 billion people do not have reliable flood alerts, 5 billion people cannot have parametric insurance for farmers, sectors of the economy are suffering.

You know, when you fly to Cancun Mexico, did you know that the pilot doesn’t know what is the weather until they approach the airport? Because there’s no radar. And that’s the case for most of destination you fly too. Now, beyond that, the oceans and the seas are not covered with radars. So, I don’t know if you’re that, but all the most important weather phenomena that go over the ocean. Hurricanes in the Atlantic, we fly airplanes over the eye of the storm to get to scan it with a radar and send it back to the model that’s in 2022. It’s unbelievable. Nobody’s doing that for cyclone and Typhons in the east. So over there, the situation is worse. We wanted to solve of that problem. So, a few years ago, we started searching. Who’s going to do that? We went to NASA JPL. We went to Noah.

We went to all the big companies. We went to small space companies. We realized that nobody’s going to build radars at scale. So, we said, okay, let’s do it. And we started working line and we developed a very unique capability that is cost effective. We minimize the size of the radar to about a mini fridge from a school bus size. And now we got it to the point where it makes sense to cover the world with active radars that will give us close to real time refresh rate for every point on earth. When we finish doing that, it’s going to be a revolution in weather forecasting and climate science. I would say it can be the equivalent of GPS for weather because no airline will allow itself to take off from JFK to London over the ocean, without using it. No ship will sail in the ocean from Denmark to Boston without using it and no farmer or no insurance company will allow itself not to use this data because they will miss on an amazing opportunity to optimize.

That’s why we did it. It’s a huge impact. It’s a huge mission. It’s a one for the lifetime invention. And we were able to do it at a relatively low cost in a world where, you know, everybody printed so much money and it goes to AgTech and travel. And what I call P2P, privileged to privileged solution. We are going to help every individual on earth. How many companies’ CEOs can say, if my company succeeds, every citizen in the world will benefit from it. Every company in the world will benefit from it, except for our competitors maybe, but it’s huge. It’s huge. So, when you see something like that, you stop thinking like a VC, like, oh, this is a SaaS company you cannot do hardware. No. Who cares? This is such a huge technology, it’s not just remote sensing. It’s one of the toughest problems in remote sensing that we’re tackling. And when we do it, it’s going to feed our models that will feed our insights that will help our customers make more decisions, like how to avoid outage, like how to fly more efficiently, like how to save the bottom line on the roads. That’s why we did it.

Julian Klymochko: They say that as a climate change, we’re having more extreme weather patterns, natural disasters. And you mentioned the hurricanes and Southeastern United States and the Caribbean. And they just cause billions and billions of dollars in damage. So, I’m surprised that no one as really tried to solve that problem before you guys but looks like you’re on it. The other interesting point you made is that the combination of both the software and the hardware, we’re seeing that more and more often these days, if you look at electric vehicles, for example, in autonomous driving, you need to build that hardware such that you have correct data being fed into the software. So that certainly makes sense from my perspective. And you guys got big plans. I mean, launching satellites that cannot be cheap. You guys did announce in December going public, raising some capital there. So, I was wondering if you get into the details of that transaction and why you chose to merge with SPAC Pine Technology Acquisition.

Shimon Elkabetz: Yeah. So generally, why SPAC? I actually wrote a blog about it. So, you know, we’re not trying to follow trends. If we were to follow trends, we wouldn’t do it. We actually went through the pie process in probably one of the most difficult times to do so.

Julian Klymochko: Right.

Shimon Elkabetz: We are doing it because of the following reasons. This company is doing something so historic, it’s a high growth SaaS business with [Inaudible 00:24:05] technology, but one that tackles every element of ESG and that is going to create a huge impact in the world. And we need the brand recognition. We need to be public, and I believe that such company needs to allow everyone to support it. It’s not just a matter of one VC or two VC, its one area, but, you know, thinking a little bit more selfishly I, and my co-founders and the investors. We understand from the beginning that we want to build the largest and most disruptive weather technology company in the world.

We want to build a sustainable business. We know that eventually we’ll go public. Of course, you can stay private and raise money in inflated valuations that are disconnected from planet earth, but what’s the end game? Just look at what happened in the market in the last few weeks to all the SaaS companies. valuation drop significantly. So, I can keep telling myself that I’m a multi unicorn or whatnot, but what’s the point? I mean, I want to build a sustainable business and we found a great opportunity in doing it now with the right partners, which is buying technology. First of all, they sponsor are from AmTrust Financials. Great group of people. We have of great understanding, and they believe in vision of the company, and they knew the company. They’re a customer of the company. And I believe that they can add a lot of value to our board.

There SPAC size is sizeable. So even in a scenario of high redemption, which is likely in this market. We’ll have enough money to execute on the plan and get the company to profitability. And lastly, I would say we are long term oriented. So, we don’t think about the next quarter or the next two quarters. We understand exactly the value that we create. We know that this transaction will fund us all the way to finishing our mission and going beyond it and turning the business into a big, sustainable business. So, from our perspective, it gives us the ability to mature the company, take it to the next step, show more credibility in the market, increase brand awareness with great partners. And that’s why we decided to do it

Julian Klymochko: Now. Some details behind the growing public transaction. So, $75 million pipe financing. Had some high-profile investors behind that at $10 per share, $729 million enterprise value and an estimated perform equity value of 1.2 billion. So, what has been the feedback from investors thus far about you guys going public?

Shimon Elkabetz: I mean, pretty positive. And I think just like your reaction, people are enthusiastic about the mission of the company. They see the great customers that we have. I don’t know if it’s true, but there’s a scenario where we are the first company to go public in the U.S. that is solely focused on weather and climate. That’s our key mission. In a time of climate change, it’s much needed. The desire to see ESG implemented across every public company is also a driver because what we’re doing is helping companies apply and implement ESG strategies. So overall the reaction is good. Obviously, people ask why SPAC? Look at what’s happening in the market. And obviously those who asked, got the same answer that I just gave you a couple of minutes ago. But overall, you know, people are cheering for the company. Because again, if we’re successful, it’s good for everyone.

Julian Klymochko: That’s great. And you mentioned the mission in talking about mitigating climate change, addressing ESG. Do you see that as a major focus of the company? Is that, you know, what you guys are all about is helping other are companies mitigate the changing climate and increasing their ESD credentials?

Shimon Elkabetz: I think it’s everything. It’s not just, you know, anecdotal point it’s everything. Because climate tech is about two things, right? It’s about climate mitigation, net zero and climate adaptation. The reality is here. How do we deal with it? How do we adapt to the new reality? There is no other company that I can think of that is so strong on the adaptation piece. Our solution is helping every company implement the strategy to minimize the damage and the volatility of climate and weather. Now, we believe that climate security will become the new cyber security, just like every boardroom, thinking about IT risk and exposure. Boardrooms will start thinking about their climate exposure. Now this closing the risk, like what the [Inaudible 00:29:28] about to mandate is not enough. Imagine that I would say, hey, I have a risk in disturber, but I wouldn’t do anything about it.

As a CEO, I would have been held accountable. Similarly, if someone is seeing a risk, we can help manage it. You cannot sell your entire portfolio of real estate in Manhattan this afternoon. You cannot also build the wall around Boston this afternoon, but guess what? You can put a software in place, and that’s what we’re doing. And, you know, there’s a lot of greenwash around ESG.

Julian Klymochko: Yeah.

Shimon Elkabetz: You know, when you look at ESG indexes, you find big tech companies unrelated to ESG.

Julian Klymochko: Yeah.

Shimon Elkabetz: I think that fund that really look for companies that not only rank internally on ESG, but actually focus on environmental impact, on so social impact, on helping boards put governance systems in place to manage the risk. We can be the poster board because we’re a for profit, high growth SaaS business with crazy deep technology with patents and also doing good with our impact on every element of ESG. So definitely we look for investors that believe in that. We look for customers that believe in that. We look for employees that believe in that. And I think that’s why we exist, honestly.

Julian Klymochko: It’s interesting the notion of climate security, and I’m sure that will only become more prevalent in the future. And then ESG, it’s obviously a huge theme for investors and increasingly so more and more focused on the ES, the environmental aspect. So, you guys seem like you could become one of the key players there, because as you indicated, you look at these ESG indices and there really isn’t a lot of expertise. Quite a few of them are just not oil and not tobacco and that makes you ESG. But I digress if investors are interested in looking more into the company as a potential position, the stock, the SPAC is currently trading under the ticker symbol PTOC. The business combination is expected to close the first half of 2022 in which you’ll change the ticker symbol to TMW so that’s Tomorrow.io. Shimon thanks so much for coming on the show, talking about the business, how you came up with it. And it’s a super cool business model. I like seeing that innovation and I can tell you’re very passionate about addressing these climate risks and making things better for those trying to deal with climate change. So, thank you very much and we wish you the best of luck.

Shimon Elkabetz: Thank you so much. It’s been great to be here.

Julian Klymochko: All right. Take care. Bye everybody.

Thanks for tuning in to the Absolute Return Podcast. This episode was brought to you by Accelerate Financial Technologies. Accelerate, because performance matters. Find out more at www.AccelerateShares.com. The views expressed in this podcast to the personal views of the participants and do not reflect the views of Accelerate. No aspect of this podcast constitutes investment legal or tax advice. Opinions expressed in this podcast should not be viewed as a recommendation or solicitation of an offer to buy or sell any securities or investment strategies. The information and opinions in this podcast are based on current market conditions and may fluctuate and change in the future. No representation or warranty expressed or implied is made on behalf of Accelerate as to the accuracy or completeness of the information contained in this podcast. Accelerate does not accept any liability for any direct indirect or consequential loss or damage suffered by any person as a result relying on all or any part of this podcast and any liability is expressly disclaimed.

See How Tomorrow.io Can Help