The Netflix mockumentary Death to 2020 carries the tagline: “A year whose story couldn’t be told until now because it was still happening.” But now 2020 –– a year which felt decades-long –– is finally over, and we can look ahead to what 2021 has to hold.

While the cheers for the end of 2020 have long since subsided, and we’ve all faced the realization that the new year hasn’t brought instant relief, there is a lot to be positive about when it comes to the freight market outlook for 2021.

So what can you expect to see in the transportation freight industry for the next year? It’s better than you might expect.

The first half of 2020 was marred by the uncertainty of the pandemic. However, growth in The Purchasing Managers’ Index –– an index of the prevailing direction of economic trends in manufacturing and service –– in the second half of 2020 was a cause for optimism for freight markets and demand. It sets the industry up for a positive first half of 2021 and beyond.

Trucking

There are bullish signs for the trucking industry in 2020, with one forecasting firm predicting that truck loadings will rise 5% in 2021. This increase is being driven by several areas including:

- The potential for further stimulus from the Biden Administration

- Wide sales-to-inventory spreads

- The need for inventory replenishment

Consumer spending is expected to bounce back, which will also drive up trucking loadings. although it will be a tale of two halves. In the first half of 2021, consumers will likely continue to spend on goods which is good news for trucking operators, but in the second half when lockdowns have potentially eased and vaccinations have been rolled out (at least in some areas), services are likely to boom.

Trucking operators and logistics survivors that will thrive in 2021 are those who use automation technology, such as robotics, blockchain, and predictive analytics to stay ahead of the curve.

Maritime and Shipping

While blank sailings –– carriers canceling a sailing or skipping a port –– were commonplace last year, 2021 is already shaping up to be a very different story. As of mid-January 2021, ocean container carriers had announced just five blank sailings on the trans-Pacific route and seven on the Asia-Europe route. This is far below previous years.

Continuing COVID-19 disruptions have caused container equipment shortages and resulted in importers pulling forward demand to try to rebuild inventories from last year. As demand is likely to continue to be high, industry analysts expect there to be congestion, delays, equipment shortages, and higher rates potentially until the end of Q2.

For the last second half of 2021, a resurgence in COVID-19 and any resulting lockdowns, along with geopolitical tensions, could disrupt demand. However, HubSpot’s report predicts that international maritime trade should benefit from less uncertainty and volatility overall in 2021.

Air Freight

In 2020, airlines grounded passenger flights across the globe due to the COVID-19 pandemic, as countries shut their borders and demand plummeted. The air freight industry didn’t quite suffer the same fate, as by September air cargo volumes had only declined 8% when compared to 2019.

In 2021, lack of capacity will hamper the industry. Normally, about 50% of air cargo capacity is moved in the hold of passenger aircraft, but the continued low volume of both short-haul and long-haul air passenger travel will restrict air cargo growth, even factoring in the passenger aircraft that have been retrofitted to accommodate freight.

However, air cargo demand is expected to recover to pre-COVID levels around March or April. This will be driven by:

- An improving economic backdrop

- The essential role of air cargo in the distribution of COVID-19 vaccines

- The continuing growth of e-commerce

- US importers de-risking their supply chains from tension with China by moving to countries deeper in Southeast Asia as well as the Indian Subcontinent

Intermodal

Remote work and ecommerce became the norm in 2020, and the question remains about whether we will ever return to pre-COVID working and shopping habits. Ecommerce poses challenges for intermodal operators as customers expect same-day or next-day delivery, which means goods have to be stored at local fulfillment centers. In contrast, intermodal operations normally mean goods are stored at large warehouses near major rail terminals.

But it’s not all doom and gloom. In January 2021, intermodal freight volumes were up 12.1% compared to January 2020.

Shippers need to replenish their inventory levels, with ocean shipping lines expanding capacity on trans-Pacific services to ease this problem. Some factors suggest consumer spending on goods rather than services will remain high, which is good news for intermodal. These factors include:

- Record consumer wealth levels

- Near-zero interest rates

- Record stimulus packages

- An improving employment outlook

Domestic truckload-based intermodal providers are also likely to increase the size of their container fleets, and use this fleet more effectively, which will boost intermodal capacity.

Weather and Technology

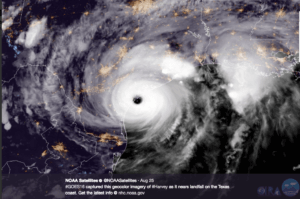

According to HubSpot, long-range forecasts from the Climate Prediction Center suggest the current La Niña pattern will last into the summer of 2021 before moving into a neutral scenario. These patterns normally mean there will be an active hurricane season in the Atlantic basin and warm and dry conditions in the Southwest.

There is also likely to be flooding across portions of the upper Mississippi in the spring and a more predictable harvest schedule in the Southwest.

Freight companies need to plan ahead to ensure they can adequately deal with these changing conditions, minimizing disruption while keeping their employees safe.

One aspect that will help with managing changing and extreme weather conditions is the accelerating pace of technology, and the ability to make data-driven decisions.

HubSpot identified the following as driving innovation in the freight market:

- Digital freight-matching systems

- Supply chain visibility

- Highly efficient autonomous inventory storage systems

- Multi-technology integration platforms

- Real-time benchmarking data and asset tracking

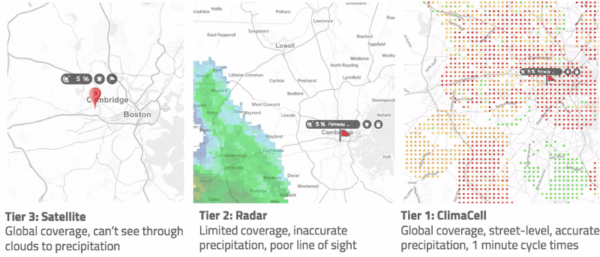

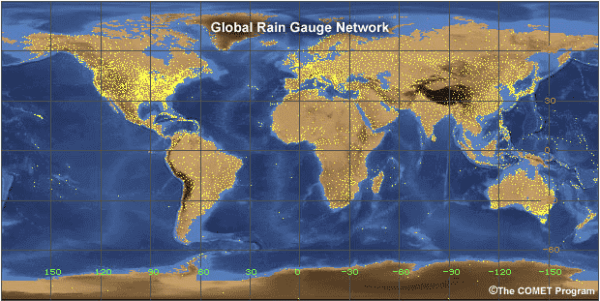

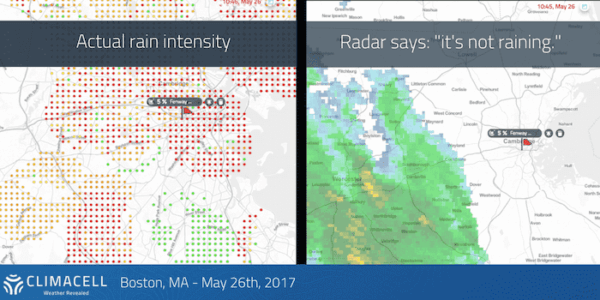

Weather intelligence can also help companies harness data to make better operational decisions.Tomorrow.io’s Predictive Weather Intelligence Platform can directly alert organizations as to the business impact of the weather and the actions to take to prepare in advance.

Freight companies likely already know the kinds of weather that most affect their business, but they need to be able to prepare for disruptions in advance and respond more quickly. Knowing the weather’s impact shifts your organization from reactive to proactive, giving you one less thing to worry about as you navigate whatever 2021 has to offer.